An Introduction to End-User Natural Gas Hedging - Part IV - Call Options

This post is the fourth in a series where we are exploring the various hedging strategies which are available to commercial and industrial natural gas consumers. The first three posts can be found via the following links:

- An Introduction to Consumer Natural Gas Hedging - Part I - Futures

- An Introduction to Consumer Natural Gas Hedging - Part II - Swaps

- An Introduction to Consumer Natural Gas Hedging - Part III - Basis

In future posts we'll explore how commercial and industrial natural gas consumers can hedge with collars as well as other strategies.

There are two primary types of options, call options (also referred to as a caps or ceilings) and put options (also referred to as floors). A call option provides the buyer of the option with a hedge against higher prices. Conversely, a put option provides the buyer of the option with a hedge against lower prices.

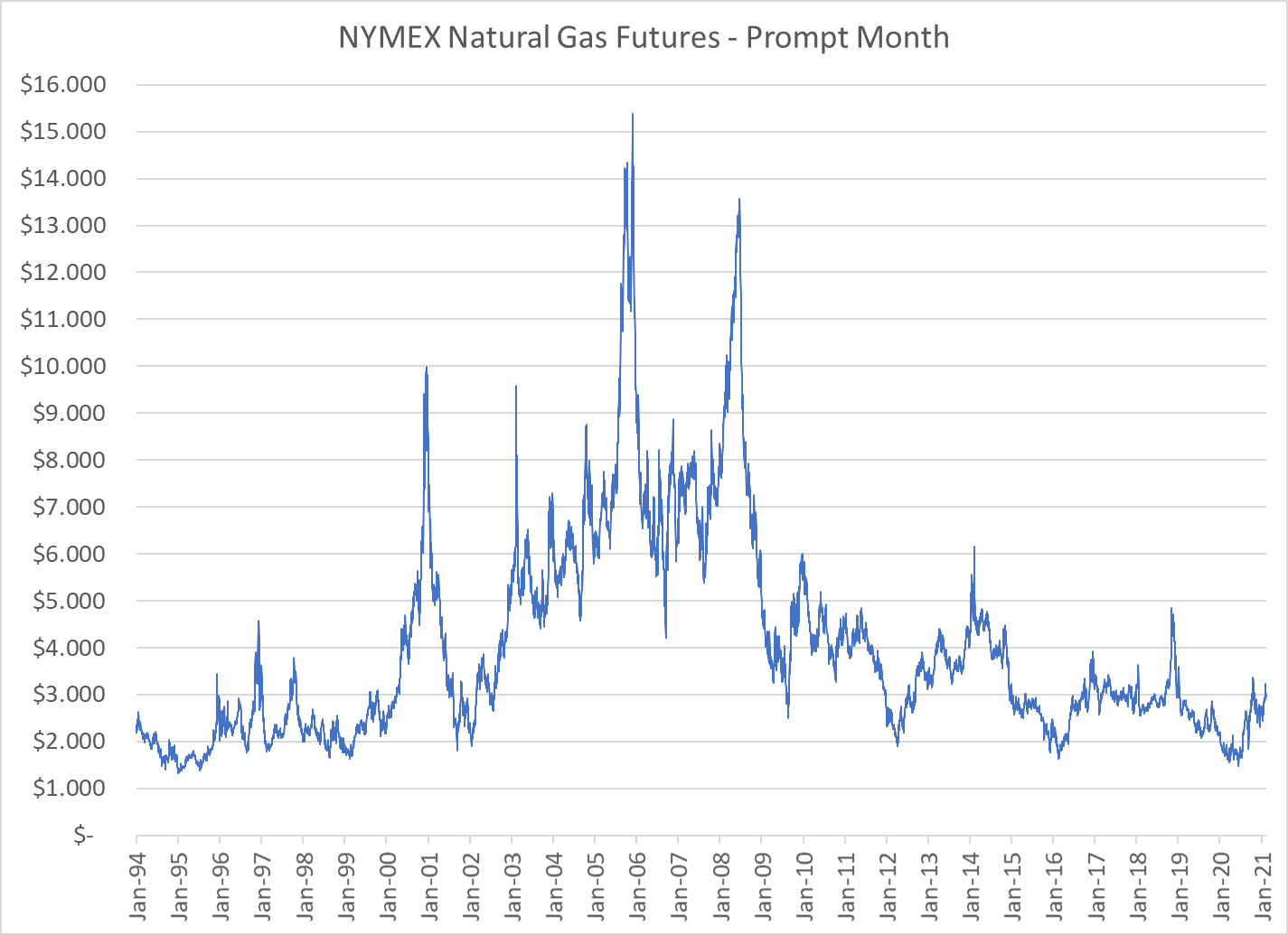

Natural gas consumers often hedge with call options to mitigate their exposure to potentially higher natural gas prices. As an example of how a natural gas consumer can utilize a call option to hedge their exposure to higher natural gas prices, let's assume that you're a manufacturer who consumes natural gas in your plant(s). Let's further assume that you gas hedging policy states that any hedge transaction you enter into must ensure that your your natural gas allows you to hedge at the price included in your budget of $3.50/MMBtu or better (excluding basis, transportation and distribution). For sake of simplicity, let's assume that you are looking to hedge 10,000 MMBtu of your anticipated, demand in July.

In order to do accomplish this, you could purchase a July NYMEX natural gas call option. Given that you budget calls for a price of $3.50/MMBtu or better, you could purchase a July near-the-money (a strike price or "cap" near the current July forward price of $2.919) call option with a strike price of $2.93 for a premium of $0.186/MMBtu which would ensure that your worse case scenario (highest cost) is $2.93 or a net of $3.116, including the option premium.

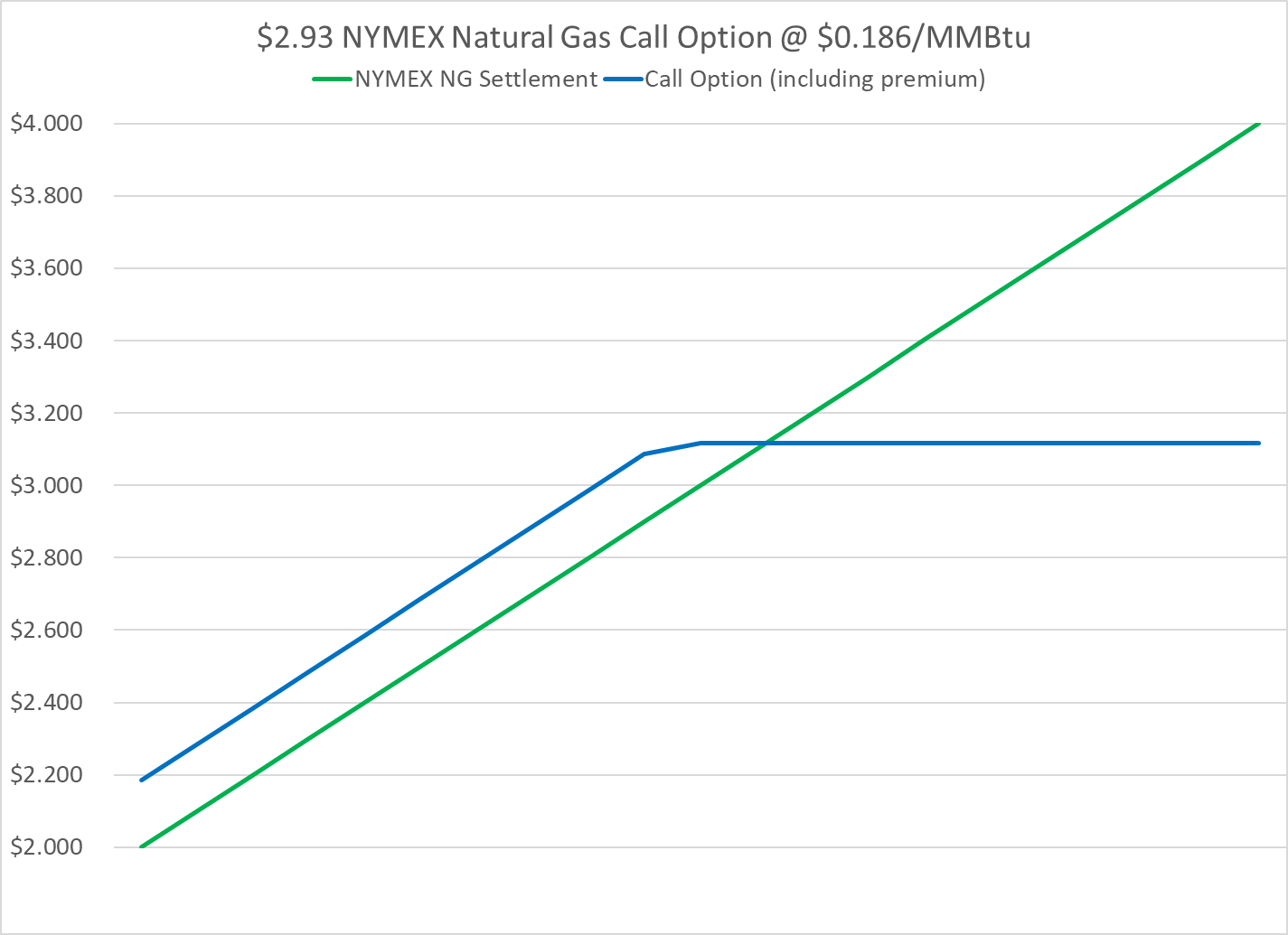

Moving forward, let's examine how this call option would impact your July gas cost if July NYMEX natural gas prices settle both above and below your strike price of $2.93. In the first case, let's assume that the July NYMEX natural gas futures contract expires at $3.50. In this case, your call option would produce a gross hedge gain of $0.57/MMBtu or a net hedge gain of $0.384/MMBtu ($0.57 - $0.186 = $0.384). In this scenario, you would pay your gas supplier $3.50/MMBtu but the higher price would be offset by the hedging gain, resulting in a net price of $3.116/MMBtu when accounting for both the hedge gain and the option premium cost.

In the second case, let's assume that the July NYMEX natural gas futures contract expires at $2.50. In this scenario, your call option would produce a neither a gross hedge gain nor a hedge loss as the expiration price of $2.50 is below the strike price of $2.93. In this case, you would pay your gas supplier $2.50/MMBtu but would incur a net cost of $2.686/MMBtu including the premium cost of the option of $0.186/MMBtu. Recall, both of this cases exclude basis, which we covered in the previous post in this series, transportation or distribution costs.

The graph shown above indicates the "payoff" of the July $2.93 NYMEX natural gas call option. As the graph shows, if July NYMEX natural gas futures expire at $2.93 or higher, your cost net cost will be $3.116/MMBtu (including the option premium of $0.186). On the other hand, if July NYMEX natural gas futures expire at less than $2.93, your cost will be the settlement price of the NYMEX natural gas futures plus $0.186 (to account for the option premium of $0.186/MMBtu).

While many natural gas consumers tend to hedge with futures or swaps, hedging with call options can be an ideal hedging strategy as call options provide a hedge against higher natural gas prices while also providing the opportunity to benefit from lower natural gas prices, should prices settle below the strike price of the option. In essence, hedging by purchasing call options allows you can have the best of both worlds, regardless of whether natural gas prices increase or decrease.

UPDATE: The previous and subsequent posts in this series can be accessed via the following links:

- An Introduction to Consumer Natural Gas Hedging - Part I - Futures

- An Introduction to Consumer Natural Gas Hedging - Part II - Swaps

- An Introduction to Consumer Natural Gas Hedging - Part III - Basis

- An Introduction to Consumer Natural Gas Hedging - Part IV - Call Options

- An Introduction to Consumer Natural Gas Hedging - Part V - Costless Collars

- An Introduction to Consumer Natural Gas Hedging - Part VI - Call Spreads