An Introduction to End-User Natural Gas Hedging - Part II - Fixed Price Swaps

This post is the second in a series where we are exploring the various hedging strategies which are available to commercial and industrial natural gas consumers, also known as end-users. You can access the first post via this link - An Introduction to End-User Natural Gas Hedging - Part I - Futures. In subsequent posts we'll explore how commercial and industrial natural gas consumers can hedge with options, basis swaps and more complex instruments.

While the last post focused on hedging natural gas with futures contracts, today we're going to look at how natural gas consumers can hedge their natural gas price risk with fixed price swaps. A swap is a contractual agreement whereby a floating (or market) price is exchanged for a fixed price or a fixed price is exchanged for a floating price, over a specified period(s) of time. Swaps are called such because the transaction involves buyers and sellers “swapping” cash flows.

So how can natural gas consumers can hedge utilize fixed price swaps to hedge their natural gas costs? As an example, let's assume that your company is an industrial natural gas consumer in the Allegheny County, Pennsylvania and that you need to ensure that you natural gas costs this summer are equal to or less than your budgeted cost. To keep this example simple, let's further assume that you are looking to hedge 10,000 MMBtu of your anticipated July natural gas consumption. In order hedge your January natural gas cost, you could purchase one July, Dominion South Point, which is the natural gas trading hub of the Allegheny County, PA area, fixed price natural gas swap for 10,000 MMBtu. If you were to purchase this swap as of the close of business today the price would be approximately $2.235/MMBtu.

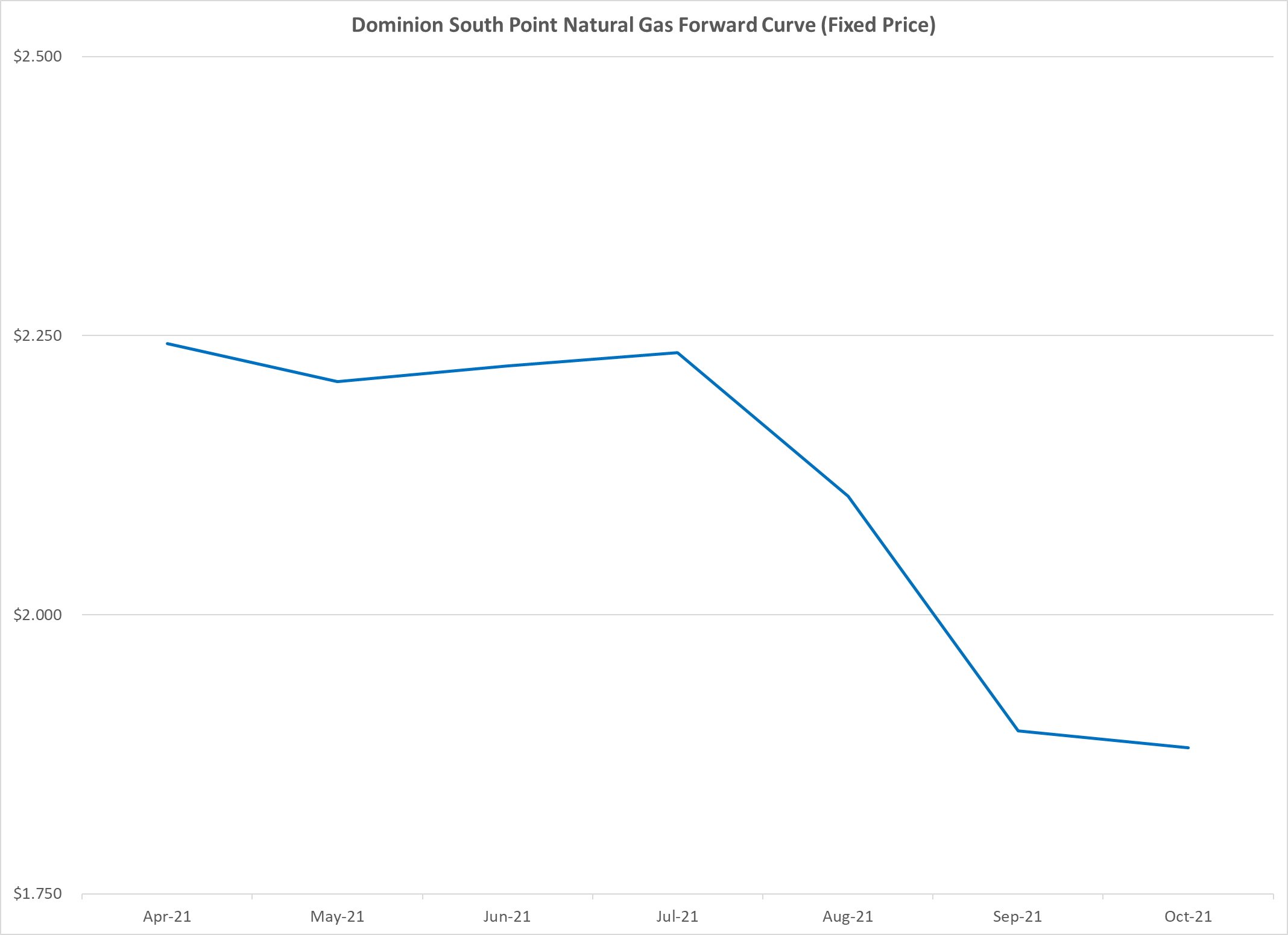

Due to the lack of summer demand, relative to peak winter demand, natural gas in the region tends to trade at a significant discount in the summer, as can be seen in the following chart. So while the NYMEX Henry Hub natural gas futures for July are currently $2.919/MMBtu, the July Dominion South Point – Henry Hub basis swap is currently trading for -$0.684/MMBtu (notice the negative sign), hence the net price of the fixed price swap of $2.235/MMBtu.

Now let's take a look at how this swap would impact your July natural gas costs if the price of the July Dominion South Point fixed price natural gas swap increases and decreases between now and the end of the end of July when the swap expires.

In the first case, let's assume that the July Dominion South Point fixed price natural gas swap settles at $2.50/MMBtu. In this case, your natural gas supplier would send you an invoice for approximately $2.50/MMBtu (excluding their profit margin and local transportation and distribution costs). However, your net cost (again excluding your supplier’s profit margin and local transportation and distribution costs) would be $2.235/MMBtu due to your hedging gain of $0.265/MMBtu ($2.50-$2.235=$0.265).

In the second case, let's assume that the July Dominion South Point fixed price natural gas swap settles at $2.00/MMBtu. In this case, your natural gas supplier would send you an invoice for $2.00/MMBtu. However, due to your fixed price hedge at $2.235/MMBtu, you would incur a loss on the swap of $0.235/MMBtu ($2.235-$2.00=$0.235).

In summary, hedging with a fixed price natural gas swap allows a natural gas consumer to fix their natural gas cost, regardless of whether natural gas prices rise or fall between the date that they enter into the transaction and the expiration date of the transaction. If the price of natural gas in their local market (in this example, Allegheny County, PA) increases, the gain on the swap offsets the increase in their actual cost. On the other hand, if the price of natural gas in their local market decreases, the loss on the swap is offset by a decrease in the actual cost.

In the next post in this series we will address basis risk and how natural gas consumers can hedge their natural gas basis risk with basis swaps.

UPDATE: The previous and subsequent posts in this series can be accessed via the following links:

- An Introduction to End-User Natural Gas Hedging - Part I - Futures

- An Introduction to End-User Natural Gas Hedging - Part II - Swaps

- An Introduction to End-User Natural Gas Hedging - Part III - Basis

- An Introduction to End-User Natural Gas Hedging - Part IV - Call Options

- An Introduction to End-User Natural Gas Hedging - Part V - Costless Collars

- An Introduction to End-User Natural Gas Hedging - Part VI - Call Spreads