3 min read

An Introduction to Energy Basis, Basis Risk and Basis Hedging

Nearly every day our team spends a meaningful amount of time discussing basis differentials, basis risk and mitigating basis risk, yet basis is a...

3 min read

Mercatus Energy : Feb 18,2021

This post is the third in a series where we are exploring the various hedging strategies which are available to commercial and industrial natural gas consumers. The first and second posts can be found via the following links:

In future posts we'll explore how commercial and industrial natural gas consumers can hedge with options and more complex instruments.

In the first two posts we looked at how natural gas consumers can hedge with futures and swaps. Today we're going to look at how natural gas consumers can hedge basis risk with basis swaps. Basis is the difference in price difference between a forward (futures) market and a cash (spot) market. In the natural gas markets the primary type of basis risk is locational basis risk. A basis swap is contract which provides the buyer or seller of the swap to hedge their exposure to basis risk.

So who is potentially exposed to basis risk? Not only natural gas consumers but virtually every company with energy price risk. As an example of basis risk and how it can be hedged, assume that you are a natural gas consumer in Houston, one of the most actively traded natural gas markets, via the trading "hub" known as Houston Ship Channel, not to mention a market which is prone to weather events, primarily tropical storms, but as February 2021 showed, unexpected cold temperatures can shock the region as well.

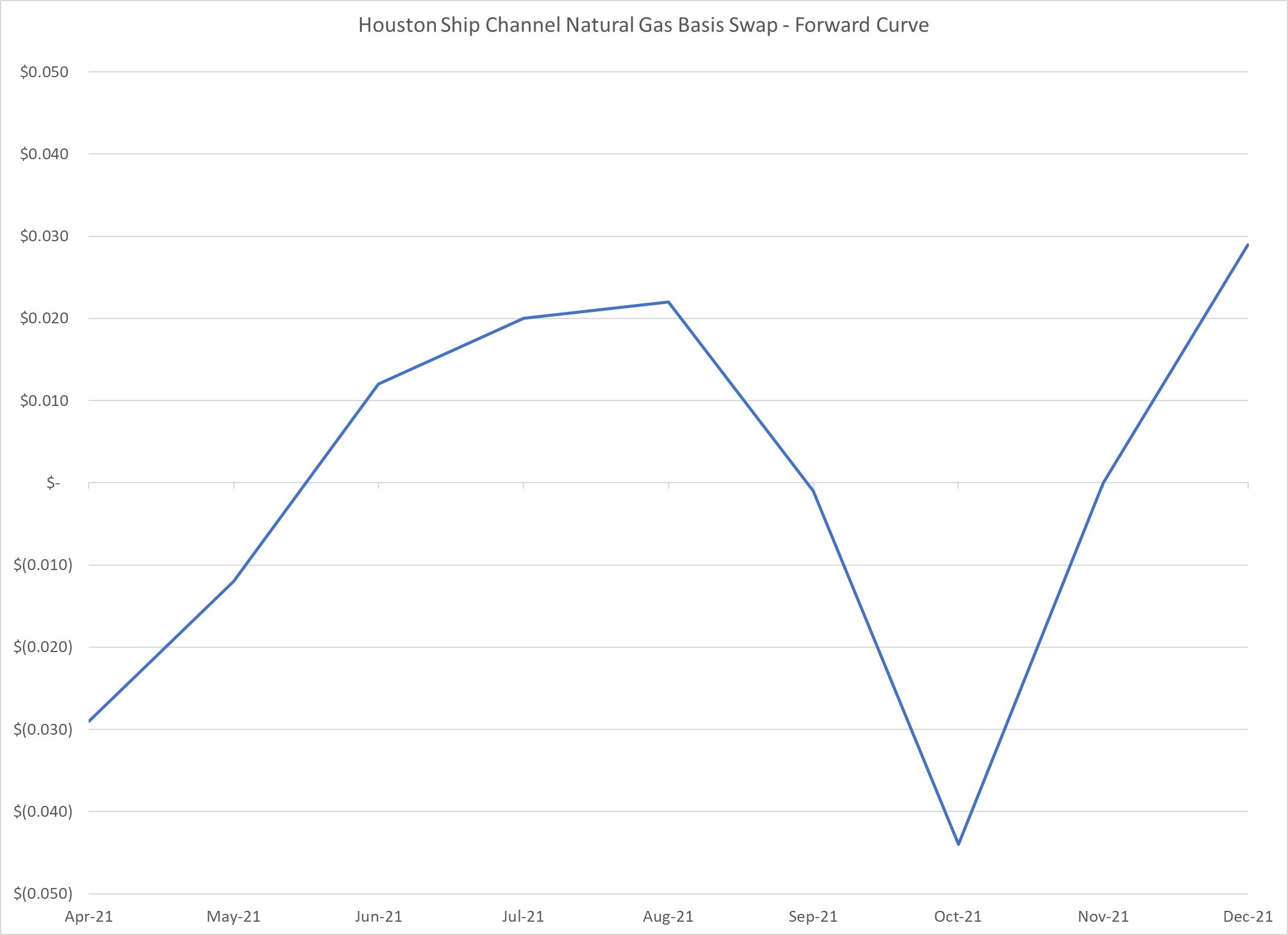

In addition, let's also assume that you have decided to hedge your August natural gas price risk by buying an August Henry Hub (also known as NYMEX, in reference to the NYMEX natural gas futures contract which is deliverable at Henry Hub - Erath, Louisiana) fixed price swap at the current price of $2.938/MMBtu. While this is a good start, if you only hedge your Henry Hub natural gas price risk, you are still exposed to basis risk. the price difference between Henry Hub and Houston Ship Channel. Therefore, in addition to the futures contract, you also need to purchase a Houston Ship Channel August natural gas basis swap which is currently trading for $0.022/MMBtu.

By purchasing the Henry Hub swap and the Houston Ship Channel basis swap you have hedged your August natural gas price risk at a total price of $2.960/MMBtu.

Moving forward, let's look at how your hedge will perform if the August Houston Ship Channel basis swap settles both higher and lower than $0.022/MMBtu, the price at which you bought the basis swap.

In the first scenario, let's assume that the August Henry Hub fixed price swap expires at $2.938. As a result you do not have a gain or loss on the Henry Hub swap. Next, let's assume that the Houston Ship Channel basis swap settles at $0.100/MMBtu. In this case your cost for August natural gas (excluding transmission and distribution fees) would be $2.960/MMBtu due to the gain of $0.078/MMBtu ($0.100 - $0.022 = $0.078) on the Houston Ship Channel basis swap.

In the second scenario, let's also assume that the August Henry Hub fixed price swap expires at $2.938. As such there is no gain or loss on the Henry Hub Swap. Contrary to the first scenario, let's assume that Houston Ship Channel basis swap settles at $0.00/MMBtu (in trading terms this is referred to as flat), meaning that the fixed price for August Henry Hub Swap and the Houston Ship Channel swap both settled at $2.938 (note the negative sign). In this case your cost for August natural gas (again, excluding transmission and distribution fees) would also be $2.960/MMBtu due to the loss of $0.022/MMBtu ($0.022 - $0.000 = $0.022) on the Houston Ship Channel basis swap.

While this example is based on a natural gas consumer hedging their natural gas price risk in Houston, the same methodology is applicable in nearly every natural gas region which has a liquid (actively traded) basis market.

For more information on basis, check out the following posts which address other aspects of basis risk and basis hedging:

UPDATE: The previous and subsequent posts in this series can be accessed via the following links:

3 min read

Nearly every day our team spends a meaningful amount of time discussing basis differentials, basis risk and mitigating basis risk, yet basis is a...

3 min read

This post is the fourth, in an ongoing series, covering the basics of energy hedging. The first three posts in the series explored energy hedging...

2 min read

Given the recent basis "blowout" between NYMEX WTI and ICE Brent crude oil we thought it would be a good time to revisit basis risk and the...