3 min read

The Layman's Guide to Gasoil Hedging with Swaps

This post is second in a series we are publishing on gasoil hedging from the perspective of a gasoil consumer. The first post in the series, which...

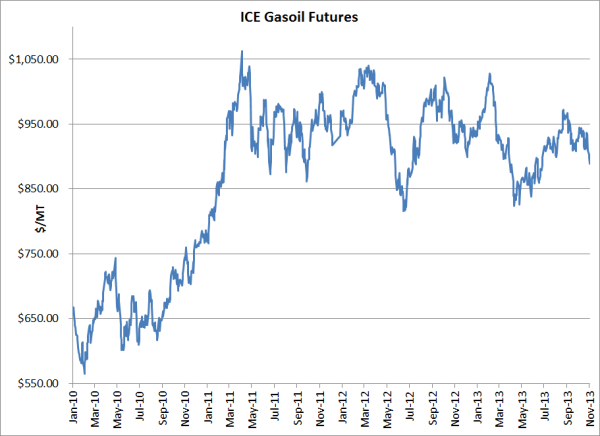

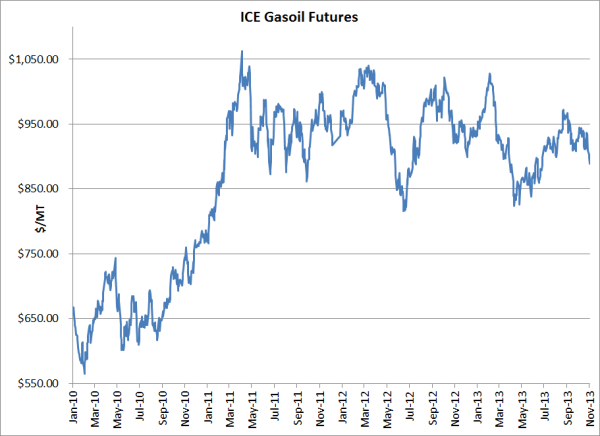

As many companies are beginning to plan for 2014, we have received quite a few inquiries from companies who are looking into hedging their gasoil price risk for the first time. As such we thought it would be beneficial to create a series of post on the various hedging strategies available to gasoil end-users.

While this post is going to focus on hedging gasoil prices with futures contracts, in subsequent posts we'll explain how fuel consuming companies can hedge their exposure to gasoil prices with swaps, call options, swaps with put options, costless collars, three-way collars, etc.

When it comes to fuel hedging, there are five futures contracts which are of primary interest, three which are traded on the NYMEX: WTI crude oil, ultra-low sulfur diesel (ULSD) and gasoline and two of which are traded on ICE: Brent crude oil and gasoil. Beyond the primary futures contracts there are also futures, swaps and options traded on numerous grades of fuel (diesel fuel, gasoline, gasoil, fuel oil, etc.) for delivery in various locations around the world, the most active being the US Gulf Coast, New York Harbor, Northwest Europe (Amsterdam, Rotterdam & Antwerp), Singapore and the Mediterranean (Italy).

In short, a futures contract gives the buyer the right to buy the underlying commodity at the price at which he buys the futures contract and vice versa for the seller. However, in practice, very few commodity futures contracts actually result in delivery (less than 5%), most are utilized for hedging and are sold (or bought back in the case of a short position) prior to date of expiration.

So getting back to the issue at hand, how can you use a gasoil futures contract to hedge your gasoil price risk?

Let's assume that you are gasoil consuming company located in the Netherlands. For purposes of this example, let's also assume that in an average month you consume 125 MT of gasoil per month and that you want to hedge 80% of your anticipated monthly consumption. One way that you could hedge your exposure is by purchasing an ICE gasoil futures contract (100 MT). To simplify this example, let's also assume that for the time being you want to focus on your anticipated fuel consumption for January 2014. If you were looking to execute hedge this exposure today, you could do so by purchasing one January ICE gasoil futures contract at the current market prices of approximately $885.00/MT.

Next let's fast forward to January 10, 2014, the expiration date of the January gasoil futures contract. Because you do not want to take physical delivery of the gasoil futures contract, you decide to sell one January gasoil futures contract at the then, prevailing market price.

In the first scenario, let's assume that the prevailing market price, at which you sell back one gasoil futures contract is $900/MT. In this scenario, your hedge would generate a "profit" of $15/MT. Excluding the basis differential (transportation costs) between ARA and the actual location(s) where you purchase gasoil, you would pay $900/MT for the fuel you consume in January 2014. However, your net cost for gasoil in January would be $885/MT (again, excluding basis), the price at which you originally bought the gasoil futures contract, due to the $15/MT profit ($900 - $885 = $15) on your hedge in the futures market.

In the second scenario, let's assume that the prevailing market price, at which you sell back one gasoil futures contract, is $875/MT. In this scenario, your hedge would generate a "loss" of $10/MT. Similar to the previous example, excluding the basis differential (transportation costs) between ARA and the actual location(s) where you purchase gasoil, you would pay $875/MT for the fuel you consume in January 2014. However, your net cost for gasoil in January would be $885/MT (again, excluding basis), the price at which you originally bought the gasoil futures contract, due to the $10/MT loss ($885 - $875 = $10) on your hedge in the futures market.

While this example focused on hedging with ICE gasoil futures, the same methodology would also apply if you were to hedging with NYMEX ULSD futures, NYMEX RBOB gasoline futures, etc. Similarly, the opposite methodology would apply to a company who needs to hedge their exposure against potentially declining gasoil prices. In this case, rather than purchasing a gasoil futures contract, the company would sell a gasoil futures contract.

While there are obviously a lot of details that need to be considered before you hedge gasoil prices risk with futures contracts, the methodology is pretty simple: if you need to hedge your exposure to potentially rising gasoil prices you can do so by buying a futures contract. Conversely, if you need to hedge your exposure to potentially declining gasoil prices you can do so by selling a futures contract.

UPDATE: This article is the first in the series on hedging gasoil price risk. The subsequent posts in the series can be viewed via the following links:

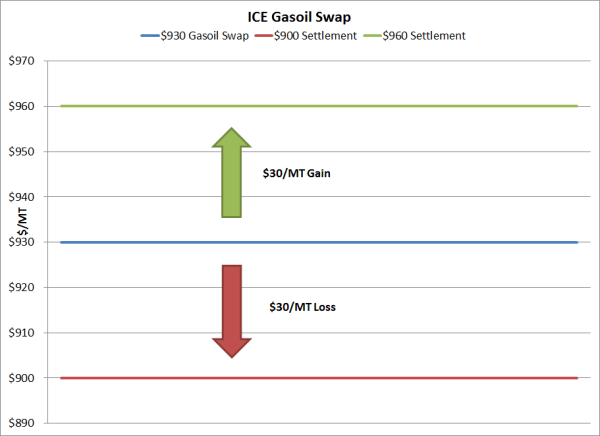

The Layman's Guide to Gasoil Hedging with Swaps

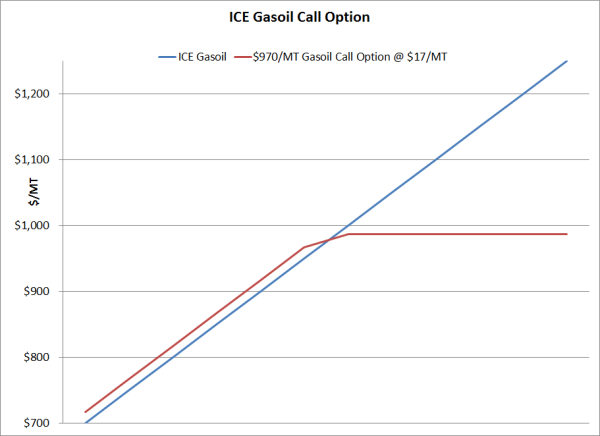

The Layman's Guide to Gasoil Hedging with Call Options

3 min read

This post is second in a series we are publishing on gasoil hedging from the perspective of a gasoil consumer. The first post in the series, which...

2 min read

In recent weeks we've explored how gasoil consumers can hedge their exposure to gasoil price with futures The Layman's Guide to Gasoil Hedging with...

2 min read

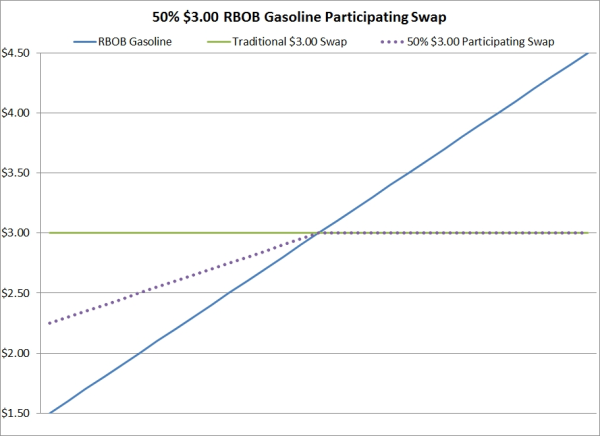

Given that more and more organizations with large fleets are seeking "low" or "zero" cost gasoline hedging strategies, which won't leave them...