3 min read

A Beginners Guide to Fuel Hedging - Swaps

This post is the second in a series where we are explaining the most common fuel hedging strategies utilized by commercial and industrial fuel...

As both Brent & WTI crude oil are now well over $100/BBL, many large fuel consumers are seeking creative hedging strategies that protect them against higher prices while also benefiting should prices decline. In addition, many companies are reluctant or unable to spend the premium to purchase options. Given these criteria, a participating swap might be an ideal hedging strategy.

A consumer participating swap is the combination of a fixed price swap and a put option. Many fuel consumers may find this hedging strategy to be attractive because the put option provides downside price protection should fuel prices decline. However, rather than the consumer paying for the put option premium at the time of execution, which would be required with a typical put option, the premium is embedded into the price of the swap.

An an example, let's assume that you are a fuel consumer looking to hedge 210,000 gallons (which is the equivalent of 5,000 barrels) of your September fuel consumption. Let's further assume that on 50% of the volume, 105,000 gallons you want to have the ability to benefit if fuel prices decline. As previously mentioned, you are also not willing/able to pay the upfront premium required of most options. As a result, you could hedge with a 50% ULSD participating swap.

Based on current market conditions, your counterparty say they will sell you the 210,000 gallon September 50% participating swap for $3.10/gallon. The price of the participating swap is determined by by taking the price of a September ULSD calendar swap of $3.06/gallon on (all 210,000 gallons) and adding the premium of a $3.06 September ULSD average price put option of $0.0750/gallon (on 105,000 gallons), for a net cost of $3.0975/gallon. In practice, they would also add their cost of capital and profit margin but we're going to leave those aside for now.

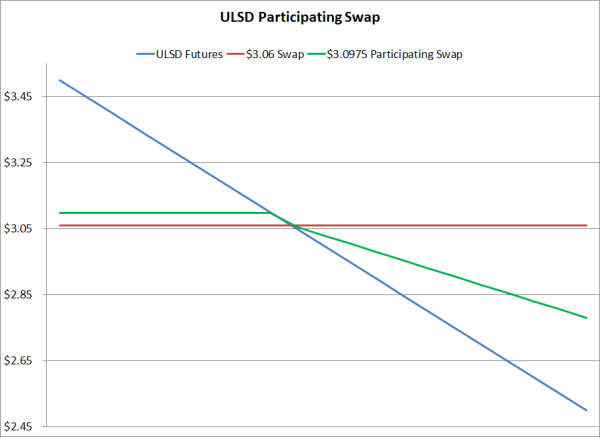

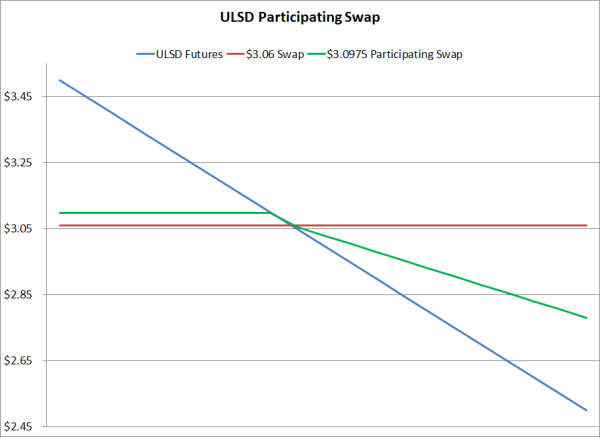

As you can see on the above chart, if the prompt month (October) ULSD futures averages more than 3.0975 during the month of September, you will have a hedging gain of the monthly average price minus 3.0975, multiplied by 210,000 gallons. As an example, if the prompt months futures during the month of September average $3.25/gallon, you would have a hedging gain of $0.1525/gallon or $32,025.

On the other hand, if the prompt month ULSD futures average less than $3.0975/gallon during the month of September, you will incur hedging loss which equates to $3.0975 minus the month average price, multiplied by 105,000 gallons. As an example, if the prompt month ULSD futures during the month of September averages $2.75/gallon, you would incur a hedging loss of $0.17375/gallon ($0.3475 X 50%) or $36,487.50.

As a comparison, if you had simply hedged your September ULSD with a $3.06 fixed price swap and the front month ULSD futures averaged $3.25/gallon, you would incur a hedging gain of $0.1900/gallon or $39,900. On the other hand, if you hedged your September ULSD with a $3.06 fixed price swap and the prompt month ULSD futures averaged $2.75/gallon, you would incur a hedging loss of $0.31/gallon or $65,100.

As these examples show, consumer participating swaps allow a fuel consumer to maintain a portion (50% in this case) of the benefit of declining fuel prices while remaining "fully" hedged against increasing prices. The trade off is that the price of the participating swap is higher than the price of a "normal" swap as the cost (premium) of the put option (the participating component) is embedded into the price of the swap.

3 min read

This post is the second in a series where we are explaining the most common fuel hedging strategies utilized by commercial and industrial fuel...

4 min read

Over the course of the past year, refining profit margins have been all over the map. As an example, over the course of the past year, the WTI-NY...

3 min read

As all large fuel consuming companies are well aware, fuel prices have increased significantly over the past couple months. Relative to their June...