Bunker Fuel Hedging & Price Risk Management - Three-Way Collars

In recent weeks, we've spoken with many bunker fuel consumers (cruise lines, shipping companies, etc.) who are seeking "more creative" hedging strategies that they can consider employing to hedge their exposure to bunker fuel prices.

Traditionally, most bunker fuel consumers hedge with fixed price swaps, call options and costless collars. While all three instruments are generally acceptable hedging strategies, they each have their drawbacks. In the case of fixed price swaps, they present potential losses if prices decline. Call options are essentially risk free (excluding basis and credit risk) but require an upfront premium payment, which can often be significant. Costless collars can provide good protection against rising prices, but similar to a fixed price swap, they also present downside price risk via the sale of a put option.

Today we're going to address another bunker fuel hedging strategy, a three-way consumer collar. A three-way consumer collar combines a traditional, consumer costless collar with the purchase of an additional put option, which mitigates the risk of being short a put option, or exposed to declining prices.

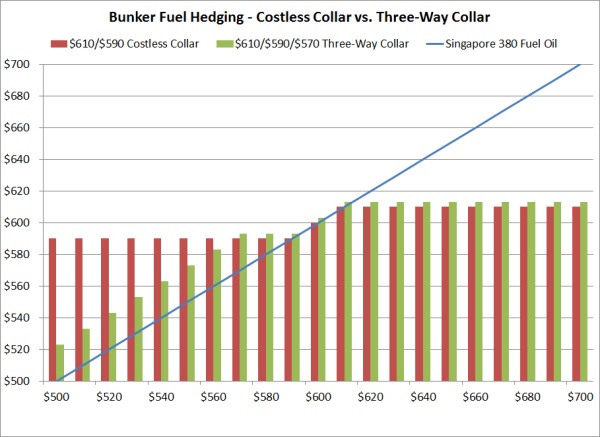

As an example, let's assume that a cruise line is considering hedging their July, Asian fuel consumption with a consumer costless collar on Singapore 380 fuel oil consisting of a cap (call option) with a strike price of $610/MT and a floor (put option) with a strike price of $590/CT. In this scenario, the cruise line is will have hedging gains if Singapore 380 fuel oil averages more than $610/MT during the month of July. If Singapore 380 fuel oil averages less than $590/CT during the month of July the company will be subject to hedging losses. If Singapore 380 fuel oil averages more than $590/MT but less than $610/MT during the month of July, the company will not experience any hedging gains or losses, they will simply be exposed to spot market prices. Clearly, this strategy works well if prices are stable or increase, but not if prices decline significantly, in this case below $590/MT.

If the cruise lines wants to utilize a more conservative hedging strategy which will limit their potential losses if Singapore 380 fuel oil falls below $590/MT, they can do so by purchasing an additional put option (floor) which would limit their maximum loss to the difference between $590 and the strike price of the additional put option.

Building on the previous example, if the cruise hedged with the same costless collar ($610 cap and $590 floor) and also purchased an additional put option (floor) at $570/MT for a premium of $3.00/MT, their risk, if Singapore 380 fuel oil prices average less than $590/MT during the month of July, would be limited to $20/MT ($590 - $570 = $20), plus an up front premium (out of pocket) cost of $3.00/MT. To clarify, if Singapore 380 fuel oil prices were to average $525/MT, the cruise line would incur a loss of $65/MT on the $590 put option and a gain of $45/MT on the $570 put option, a net loss of $20/MT.

As the chart above indicates, the traditional, costless collar provides the cruise line with a lower bunker fuel cost when Singapore 380 fuel oil prices average more than $610/MT as well as if they are within the range of the collar or near the floor of $590. On the other hand, if Singapore 380 fuel oil prices decline significantly and average $567 ($570 - the $3 premium for the additional option) or less, the three-way collar provides a superior hedging strategy to the costless collar. To put it another way, if the cruise line is willing to accept the potential losses of being short the $590 put option, if Singapore fuel oil averaging less than $590/MT, then a costless collar might be their preferable hedging strategy. However, for a more conservative company, who needs to ensure that any hedging losses will be minimal, especially in a fragile economic environment such as the current one, a three-way collar might be an ideal hedging strategy as it provides an excellent hedge against higher prices while limiting losses in a low price environment.

While this post focuses on hedging bunker fuel with three-way collars, the same methodology can be applied to crude oil, diesel fuel, gasoline, gasoil, jet fuel, NGLs, etc.

If you're interested in learning about additional bunker fuel hedging strategies, see the following posts:

An Introduction to Bunker Fuel Hedging

Hedging Bunker Fuel Price Risk With Call Options