2 min read

A Beginner's Guide to Crude Oil Options - Part III - Volatility

As we discussed A Beginner's Guide to Crude Oil Options - Part I & Part II, there are four primary factors that determine the price of crude oil, as...

2 min read

Mercatus Energy : May 10,2013

We're often asked to explain what determines the price of crude oil (as well as bunker fuel, diesel fuel, gasoil, gasoline and jet fuel) options. This post will be the first in a series on how the pricing of crude oil options.

If you are unfamiliar with crude oil options, you can think of them as a form of insurance against rising or falling crude oil prices. In return for the right to buy or sell crude oil (or it's financial equivalent) without the obligation, options buyers pay (and options sellers receive) an upfront premium, very similar to how you pay a premium for an insurance policy.

The four major variables that determine the price of crude oil options are:

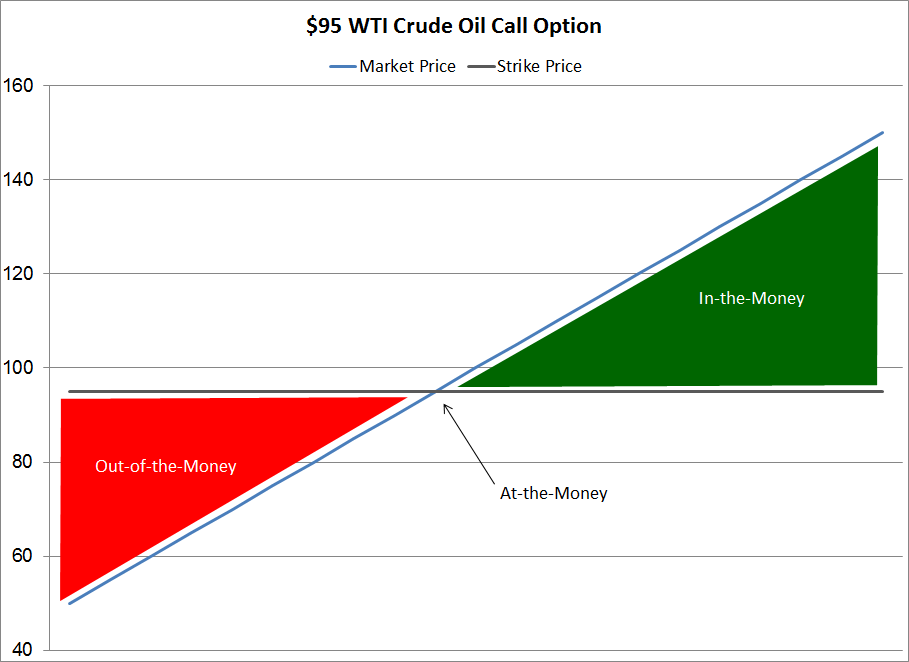

The variable which has the most influence on the price of an option is the relationship between the price of the underlying crude oil futures or swap and the strike price of the option. Depending upon the price of the underlying swap relative to a given strike price, an option is said to be at-the-money, in-the-money, or out-of-the-money.

An option is at-the-money when the strike price equals or is very close to the price of the underlying futures or swap. An option is considered in-the-money when the price of the underlying future or swap is above the strike price of a call option or when the price of the underlying swap is below the strike price of a put option. Lastly, an option is considered out-of-the-money when the price of the underlying future or swap is below the strike price of a call option or when the price of the underlying futures or swap is below the strike price of a put option.

To put the terminology into numerical context, if the June 2013 WTI crude oil futures contract were currently trading at $95/BBL, a June 2013 WTI crude oil call option with a strike price of $90/BBL would be considered in-the-money. On the other hand, if the June 2013 WTI crude oil futures contract were currently trading at $95/BBL, a June 2013 WTI crude oil call option with a strike price of $100/BBL would be considered out-of-the-money.

Conversely, if the June 2013 WTI crude oil futures contract were currently trading at $95/BBL, a June 2013 WTI crude oil put option with a strike price of $90/BBL would be considered out-of-the-money while a put option with a strike price of $100/BBL would be considered in-the-money.

The amount by which an option is in-the-money, is called intrinsic value. As an example, if the July 2013 Brent crude oil futures contract were currently trading at $100/BBL, and you owned a July 2013 Brent crude oil call option with a strike price of $75/BBL, the intrinsic value of your option would be $25/BBL. This intrinsic value, when combined with the time value of the option, are what determine the total value of the option. Alternatively, if an option is out-of-the-money, it has zero intrinsic value. As such, the price of an out-of-the-money option consists solely of the option's time value.

In our next post we'll explain how time value influences the value of crude oil options.

UPDATE: This post is the first in a series on crude oil options. The subsequent posts can be found via the following links:

A Beginners Guide to Crude Oil Options Part II - Time Value

A Beginner's Guide to Crude Oil Options - Part III - Volatility

A Beginner's Guide to Crude Oil Options - Part IV - Interest Rates

2 min read

As we discussed A Beginner's Guide to Crude Oil Options - Part I & Part II, there are four primary factors that determine the price of crude oil, as...

2 min read

This post is the second in a series on crude oil options. This first post in the series can be found via the following link: A Beginner's Guide to...

2 min read

As we discussed in A Beginner's Guide to Crude Oil Options - Part I Part II & Part III, there are four primary factors that determine the price of...