Does Hedging with Costless Collars Present Additional Basis Risk?

Over the past couple years we have addressed various aspects of both basis risk and costless collars however, until now, we have not addressed the two as they relate to one another. Which begs the question, when a company hedges with costless collars, are they potentially exposing themselves to unacknowledged basis risk?

Consider the case of a maritime company (cruise line, shipping, etc.) who has hedged their fuel oil (bunker fuel) price risk with a $110/$90 Brent crude oil costless collar, consisting of a long position on a $110 call option and a short position on a $90 put option. In essence this means that the company has hedged itself against Brent crude oil prices rising above $110/BBL while putting itself at risk if Brent crude oil prices declining below $90/BBL.

However, the company doesn't consume Brent crude oil nor does it consume fuel oil which references the price of Brent crude oil, rather the majority of it's fuel oil is priced via the Rotterdam 3.5% fuel oil index. As such, the company is exposed to the basis risk between Brent crude oil futures and Rotterdam 3.5% fuel oil. While many companies appear to understand and accept basis risk of this nature in exchange for the better liquidity in crude oil derivatives, many fail to recognize the very significant risk they are exposing themselves to when they sell options which reference crude oil (as well as heating oil/ultra low sulfur diesel and gasoil), rather than the fuel they are consuming, in this case fuel oil.

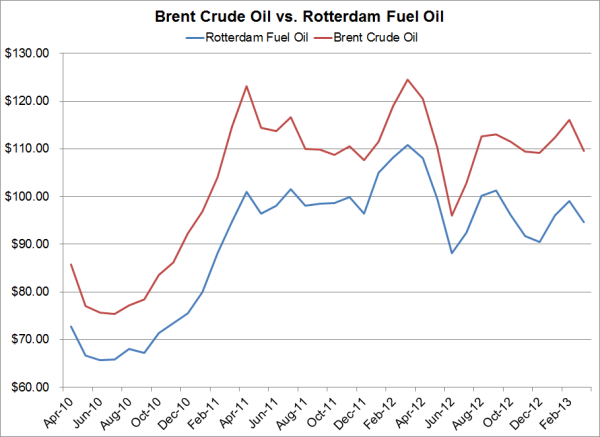

As the following chart indicates, over the past three years, the monthly average prices of Brent crude oil and Rotterdam 3.5% fuel oil are very highly correlated, approximately 97%. Note that for ease of comparison, we have converted Rotterdam fuel oil to barrels at a rate of 6.35 barrels per metric ton.

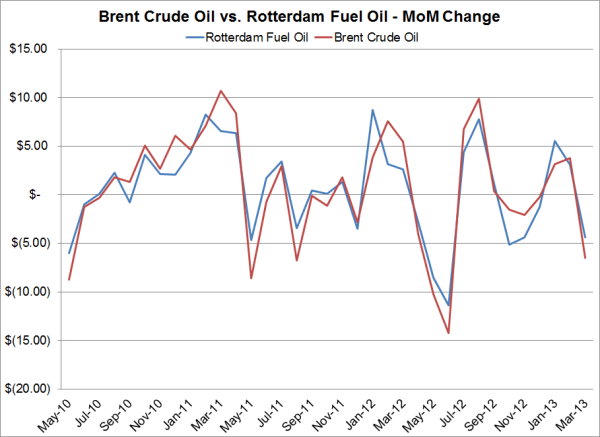

However, when we examine the correlation of the month-over-month changes between Brent crude oil and Rotterdam fuel oil, which is essential given the potential cash flow issues associated with the costless collar, the correlation isn't nearly as strong, as you can see on the following chart.

And this is where the unacknowledged basis risk may come into play for the company who is short the $90 Brent crude oil put option. When the average monthly prices of both Brent crude oil futures and Rotterdam 3.5% fuel oil increase or decrease in line with one another, the company's costless collar will perform pretty well. However, if Brent crude oil prices decrease more than Rotterdam 3.5% fuel oil, the company could find itself in a position where they are exposed to a loss on the $90 put option which is not offset by a corresponding, lower Rotterdam fuel oil price, a situation which has occurred more than a few times, as can be seen on the chart. The situation could be even worse if Brent crude oil futures were to decline while Rotterdam fuel oil prices are flat or increasing.

Clearly the opposite situation could occur as well, which would benefit the company. That is, if Rotterdam fuel oil prices were to decrease more than Brent crude oil futures, the company would benefit via the combination of lower fuel oil prices and a smaller than anticipated loss, or no loss at all, on the $90 Brent crude oil put option. However, hedging based on such assumptions is a potentially dangerous endeavor to say the least.

So how could the company mitigate their Brent Crude oil vs. Rotterdam fuel oil basis risk associated with their short $90 Brent crude oil put option? While we'll save the in-depth answer for a future post, in short, they could mitigate their exposure via a basis swap or option on the crack spread between Brent crude oil and Rotterdam fuel oil.

While our example focused on the basis risk between crude oil and fuel oil, the same methodology could be utilized to examine nearly any cross-commodity, quality or locational basis risk, as it relates to hedging with costless collars or any other strategy which involves selling options.