Hedging Energy Risk with Price Targets: A Losing Proposition?

In our role as energy hedging advisors, we regularly receive inquires from companies who have had a difficult time, if not worse, in producing desirable hedging results. On more than a few occasions, these companies have told us something similar to the following, "We set to set up our hedging program based on price targets but we ended up losing a lot of money in the process".

Hedging energy prices (regardless of whether we're talking about crude oil, electricity, natural gas, natural gas liquids or refined products) is both art and science. There's no question that prices should receive significant attention when one is determining when and how to hedge but, hedging based on price targets or market timing is neither a proper way to manage energy price risk nor to minimize your costs/maximize your revenues.

We often hear things along the lines of, "We're going to wait until prices decline below (or increase above) $100/BBL" or something similar. Both energy consumers and producers who attempt to pursue a "hedging strategy" of this nature are attempting to manage their price risk by hedging when they can obtain a price that they perceive to be attractive or advantageous. In essence, an energy producer employing this strategy is trying to maximize their cash flows and revenues by waiting for prices to increase as much as possible before executing a hedge. Ideally, these producers want to hedge at the "top of the market". On the contrary, an energy consumer employing this strategy is trying to minimize their costs and cash flows by waiting for prices to decrease as much as possible before executing a hedge. Ideally, these consumers want to hedge at the "bottom of the market". Unfortunately, most of us don't have the luxury of living in an ideal world 100% of the time.

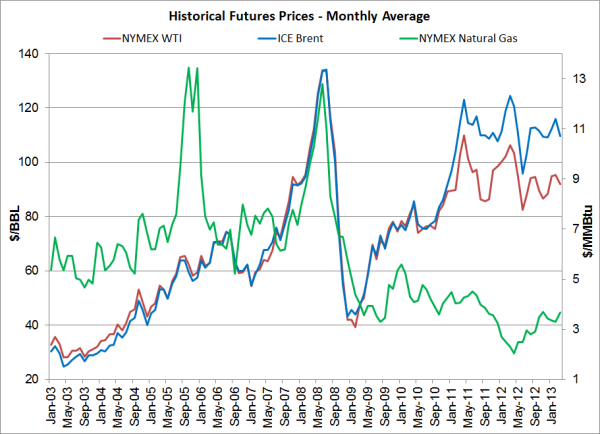

Energy commodity prices can be incredibly volatile and, in the words of often quoted economist John Maynard Keynes, "Markets can remain irrational longer than you can remain solvent." Prices can change quickly and drastically, without warning and without regard for the arbitrary price targets of those seeking to hedge their exposure to energy prices. If the Brent crude oil, one year forward curve strip is currently trading at $100/BBL, what happens to a fuel consumer with a target price of $85/BBL if the forward curve increases to $120/BBL before eventually, say five months later, finally declining to $85/BBL or lower? The pursuit of an additional $15/BBL ends up costing the company up to $20/BBL for every barrel, metric ton, gallon or liter of fuel that they consume during the initial five months. That's not risk management.

And what about an oil producer who has a price target of $125/BBL? If oil prices never rise to $125/BBL, the producer remains exposed to the market, all the way down to $85 or lower. Nor is that not risk management.

If you consider how these types of "hedging strategies" would play out, for both consumers and producer, in the long run, it won't put them in a position to effectively manage their price risk, minimize cash flow volatility or to minimize their costs/maximize their revenues. If the market never reaches their target price, the company remains fully exposed to the spot market, no matter how high/low prices go. Once again, not risk management. At best "hedging" in this manner is what we call hedgulation (hedging + speculation) and while hedgulation may produce desirable short term results, in the long run it will inevitably lead to very undesirable results.

If you've come to the conclusion that you need to incorporate price targets into your hedging strategy, you should also set a "stop loss" price(s) which essentially requires you to go ahead and execute a transaction, regardless of your price targets. Why? The stop loss will ensure that if prices move in the opposite direction of your price target, and remain in an undesirable range for an extended period of time, that you will indeed be hedged against prices moving even further away from your target price.

In short, utilizing a hedging strategy which is based on target prices and/or market timing almost ensures that the company will be exposed to undesirable price volatility or worse. In the case of producers, this means they will be exposed to the lowest prices offered by the market and, unless they are unusually lucky, they will never receive the highest prices offered by the market. Conversely, In the case of consumers, this means they will be exposed to the highest prices offered by the market and, unless they are unusually lucky, they will never receive the lowest prices offered by the market. Energy commodity prices are cyclical, hard to predict and always will be. The only certainly is that energy commodity prices will rise again and they will fall again, in no certain order.