Bunker Fuel Hedging & Price Risk Management - Call Option Spreads

This post is the fourth in a series on hedging bunker fuel price risk. The first post in the series, An Introduction to Bunker Fuel Hedging, discussed how swaps can be used to hedge bunker fuel price risk. The second post in the series, Hedging Bunker Fuel Price Risk With Call Options, addressed how a company can use call options to hedge their exposure to volatile bunker fuel prices. The third post in the series, Hedging Bunker Fuel With Costless Collars, explored the pros and cons of hedging bunker fuel prices with costless collars.

While swaps, call options and costless collars are definitely the most popular bunker fuel hedging strategies, many companies in the maritime industry are seeking additional hedging strategies which will provide them with a lower cost, short-term hedge against rising bunker fuel prices. One strategy that maritime companies may find attractive given such requirements is a call option spread, also known as a bull call spread.

A bull call spread is simply the combination of purchasing a call option with a "low" strike price and selling an additional call option with a strike price which is higher than that of the "low" strike price option.

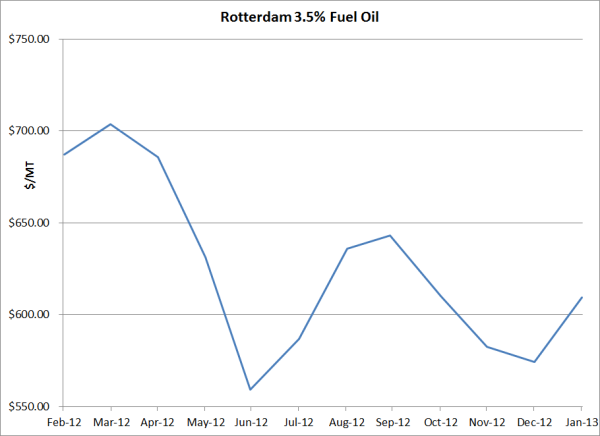

As an example, let's assume that your hedge committee has decided that you need to hedge your May 2013 European bunker fuel consumption with a call option spread. In looking at the Rotterdam 3.5% fuel oil forward curve, you see that the May swap is currently trading at approximately $640/MT and the committee has determined that you need to be hedged against bunker fuel prices rising above $660/MT. In addition, the committee has determined that the most you can spend on option premiums is $7.50/MT. Given these requirements, what hedging strategies can you employ?

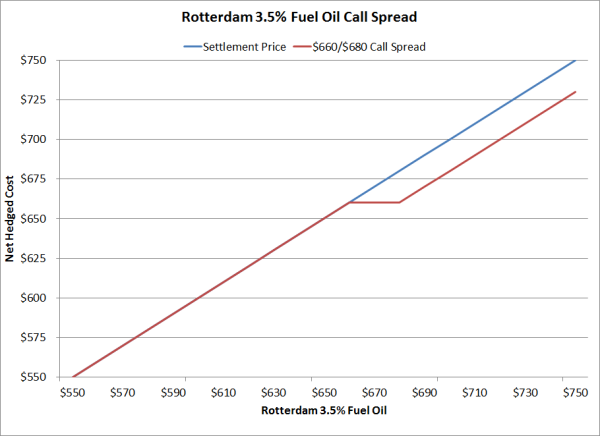

One potential strategy is to purchase a $660 Rotterdam 3.5% fuel oil call option for a premium of $17.85/MT. However, given that your option premium budget is only $7.50/MT, you can reduce the cost of the $660 call option by selling an additional call option with a higher strike price, for example, $680/MT. The $680 call option is currently trading for $11.40/MT which means that you can buy the $660 call option for $17.85 and sell the $680 call option for $11.40 which when combined form a $660/$680 bull call spread at a net premium cost of $6.45/MT, $1.05/MT below your budget of $7.50/MT .

By spending $6.45/MT, you have hedged yourself against the cost of Rotterdam 3.5% fuel oil rising above $660/MT to a maximum of $680/MT or $20/MT. The limitation of this strategy is that if the average price of Rotterdam 3.5% fuel oil during May averages more than $680/MT, the maximum that you can gain on your hedge is $20/MT.

The following chart shows the risk profile of the $660/$680 Rotterdam 3.5% fuel oil call option spread, excluding the option premium, basis, transportation and taxes.

While bull call spreads (call option spreads) are a viable hedging strategy for companies seeking a low cost, short-term bunker fuel hedging strategy, as previously noted, call option spreads only provide a limited hedge against rising bunker fuel prices, in this case $20/MT.

UPDATE: This article is the fourth in a series on bunker fuel hedging. The previous articles can be found via the following links:

An Introduction to Bunker Fuel Hedging

Hedging Bunker Fuel Price Risk With Call Options