Oil Hedging Losses Coming Soon To A Board Room Near You

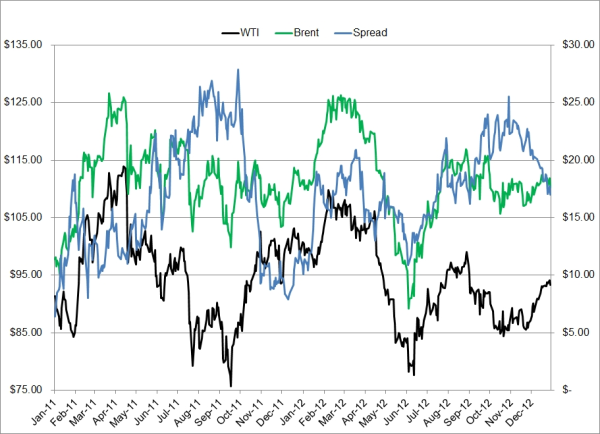

In recent weeks the Brent-WTI spread has collapsed once again, settling yesterday at just above $17/BBL after trading as high as $25.53 in mid November. As the following chart shows, the spread has varied quite drastically over the past couple years, from as low as $6.42 in early 2011 to as high as $27.88 in mid October of 2011. While the reasons for the spread expanding and narrowing are many, the recent decline is indeed different as there has been a significant change in the US crude oil infrastructure just this week.

On Monday the Seaway pipeline announced that it has completed its expansion and now has a capacity of approximately 400,000 BPD, up from approximately 150,000 BPD pre-expansion. So what does this mean for the Brent-WTI spread?

To explain, Brent is considered the global benchmark for waterborne crude oil, including the US Gulf Coast while WTI has historically been a "land locked" benchmark due to it's delivery location in Cushing, Oklahoma.

While the Seaway pipeline has been in operation for many years, in late May, Enterprise Products purchased a 50% stake in the pipeline from ConocoPhillps and, jointly, with their partner Enbridge, decided to reverse the flow of the pipeline as increasing Midcontinent and Canadian crude oil production eliminated the need for a South to North pipeline.

In addition to the reversal of the Seaway, in the coming months there is an enormous amount of capacity coming on line which will connect the Eagle Ford with Gulf Coast refineries as production in the region is expected to grow to ~1.15MM BPD. Also, in West Texas, Magelllan is going to be reversing the Longhorn pipeline, which will eventually move upwards of 200K BPD from the Permian Basin to Houston.

Such changes will lead to narrowing spreads in not only Brent-WTI but other spreads as well e.g. WTI-LLS (Light Louisiana Sweet). Some analysts are calling for the WTI-LLS spread to narrow to as little as $5/BBL (essentially the transport cost between Cushing and the Gulf Coast), from it's current level of ~$16.50/BBL. Among other things, this will lead LLS to trade more in line with WTI than Brent. As WTI priced crude begins to flood the Gulf Coast, refined product prices and, in turn, crack spreads will clearly be impacted as well.

Which brings us full circle, back to the recent decline in the Brent-WTI spread and how all of this impacts crude oil, as well as refined product, hedging. As was mentioned in our most recent post, understanding basis relationships is one of the keys to a successful hedging program. Given the dramatic decline in the Brent-WTI spread in recent weeks, it's safe to say that there are more than a few folks, who weren't aware of the pending Seaway expansion, experiencing the results of being on the "wrong" side of the Brent-WTI spread. While it's nearly impossible to have a keep up with all the spreads in the global oil markets, the deadline for obtaining a strong understanding of your exposure basis risk is fast approaching, if not already present.