Beware of Energy Derivative Marketers Promising Cash

In recent weeks we've been asked by several clients to review potential transactions which have been proposed to them by their counterparties. The common theme in each case was that the counterparty was proposing a transaction(s) which would allow said clients to receive a large cash payment in exchange for exiting one of more of their existing hedge positions.

Why would said clients want to exit these positions? In the opinion of the derivative marketers which were proposing such trades, said clients would receive a large, lump sum cash payment. Sounds appealing, doesn't it?

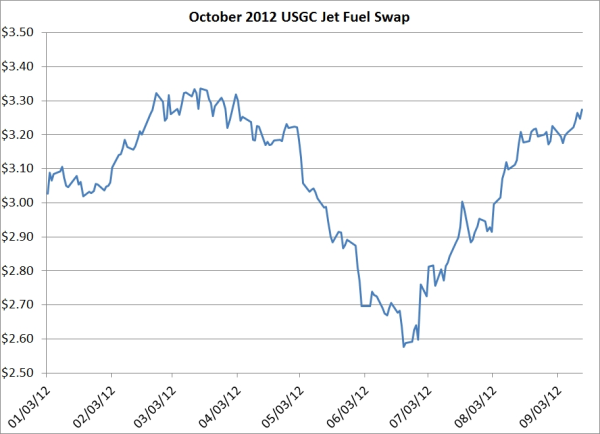

To explain, let's assume that you are an airline which had a large portion of your October - December fuel consumption when prices were lower. For example, let's assume that several months ago you hedged 5,000,000 gallons each month, October - December, with a US Gulf Coast jet fuel swap at a price of $2.75 per gallon. As of last week, the gain on your swaps would have been approximately $7,500,000 ($0.50 per gallon), assuming the swaps were trading at $3.25/gallon, which was, give or take a penny, the settlement price of these swaps late last week.

So, the pitch from the derivative marketer: "Let me buy back your October - December swaps at the current market price and I'll send you a wire transfer for $7,500,000, which you'll receive before you close your books for September".

The more important question should be, if you sell back the swaps to your counterparty what will your risk exposure look like post-transaction? The answer is pretty clear, you wouldn't be hedged for October - December, leaving you 100% exposed to potentially rising jet fuel prices for the next three months. Is the risk worth a gain and/or payment of $7,500,000? If you were completely unhedged after such a transaction, how would you cope if jet fuel prices increase over the next few months?

For most airlines looking to "optimize" in-the-money swaps, the more desirable transaction would be one which reduces your risk, rather than increasing it. As an example, as of late last week, you could have purchased an October - December US Gulf Coast jet fuel put option with a strike price of $3.00/gallon for a premium of about $0.05/gallon. What would this put option, combined with your existing swap at $2.75/gallon, do for you? It would allow you to "lock-in" a "gain" of no less than $0.25/gallon on your $2.75 swap while allowing you to remain well hedged should jet fuel prices remain high or increase further between now and the end of the year.

So why aren't derivative marketers attempting to sell put options to their customers with in-the-money swaps as opposed to trying to convince them to sell their in-the-money swaps in exchange for a large, lump-sum payment right away? In short, if the derivative marketer doesn't bother to mention to their customer that selling their back their swaps will leave said customer completely exposed to market prices, the sound of a $7,500,000 wire transfer before the end of the month might sound quite tempting.

In summary, if a derivative marketer calls you promising cash and you choose to accept their offer, chances are you have also made the decision, perhaps unknowingly, to accept undue risk.