Fuel Hedging: Swaps + Put Options = Call Options

As all large fuel consuming companies are well aware, fuel prices have increased significantly over the past couple months. Relative to their June lows, heating oil, gasoil and gasoline futures have increased all increased by about 20%.

As such we thought it would be beneficial to explain how fuel consumers can optimize their fixed price swaps, which are likely to be in-the-money, by converting them into call options. The idea being that such a conversion will provide you with continued protection against increasing fuel prices, the ability to monetize your current gains and the potential to benefit should fuel prices reverse course and decline in the coming months.

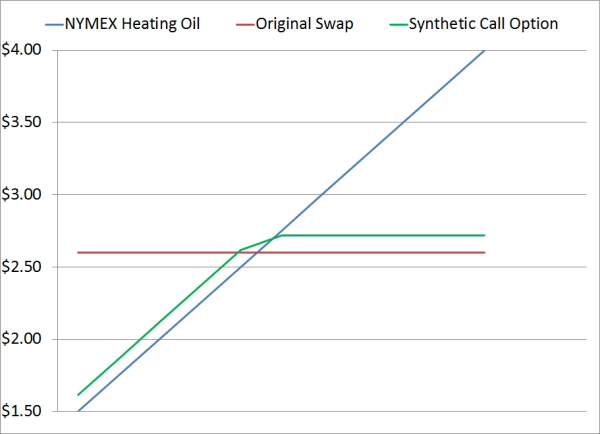

While one could easily accomplish this by selling your fixed price swaps, "pocketing" the gains, and buying call options, there is a more effective strategy which results in the same solution at a lower cost. In the trading world, we call it a synthetic call option. In practice, it is the combination of a fixed price swap and a put option, which when combined, creates a position which is the same as a call option, also called a price cap.

As an example, let's assume that Crimson Airways (a fictitious airline) has hedged their anticipated October 2012 fuel consumption by purchasing an October NYMEX heating oil calendar swap at a price of $2.60/gallon. Given the recent increase in heating oil prices, Crimson's swap is currently trading for approximately $3.10/gallon, equating to a position which is currently in-the-money by 50 cents per gallons. If Crimson were to sell the swap, for an approximate gain of $0.50/gallon, they could then purchase an $3.10 October 2012 heating oil Asian (average price) call option for approximately $0.1250/gallon. However, as previously mentioned, this is an "expensive" way to accomplish their goal as they would have to execute two transactions (sell the swap and then purchase the call option), which would subject them to the "bid/ask spread" on both occasions. In layman's terms, this means that they would have to compensate their counter-party (via the counter-party's profit margin on each transaction) on both the sale of the swap and the purchase of the call option, which could easily cost them an additional penny per gallon.

As an alternative, which would result in the same result, yet at a lower cost, Crimson could simply purchase $3.10 October 2012 heating oil Asian (average price) put option for approximately $0.1175/gallon. By retaining their existing swap and purchasing the $3.10 put option, Crimson only has to enter into one new transaction, which means that they are only subjected to the bid/ask spread on one transaction. In addition, due to call skew in October $3.10 heating oil options (which essentially means that the market currently considers the call options more dear than the put options), Crimson will save an additional $0.0075/gallon by buying the $3.10 put option rather than the selling the $2.60 swap and purchasing the $3.10 call option.

So how does the synthetic call option provide Crimson with the same result as selling the $2.60 fixed price swap, pocketing the gain and subsequently buying a $3.10 call option? In short, the $2.50 fixed price swap will continue to provides Crimson with a hedge against rising heating oil prices while the $3.10 put call option will provide them with a penny for penny gain should October heating oil prices average less than $3.10/gallon.

To put this example into a numerical context, if heating oil prices decline significantly over the next couple months and the average settlement price for heating oil futures during the month of October is $2.00/gallon, Crimson will gain $1.10/gallon on the $3.10 put option and lose $0.60/gallon on the $2.60 swap for a net gain of $0.3825/gallon (including the put option premium of $0.1175/gallon). On the other hand, if heating oil prices continue to increase and the average settlement price for heating oil futures during the month of October is $4.00/gallon, Crimson will gain $1.40 on the $2.60 fixed price swap and the $3.10 put option will expire worthless (as it is out-of-the-money) for a net gain of $1.2825/gallon (including the put option premium of $0.1175/gallon).

As a result of converting the $2.60 fixed price swap into a synthetic call option, Crimson has positioned itself as follows:

- They remain well hedged against heating oil prices rising further

- They can monetize the current "gain" of $0.50/gallon on the swap

- They eliminate a potential loss on the swap should October heating oil prices average less than $2.60/gallon

In summary, by paying the $0.1175/gallon premium and converting their fixed price swap into a synthetic call option, Crimson has guaranteed itself a "win-win" situation, regardless of whether heating oil prices increase or decrease over the next 72 days.

While many companies approach hedging with a "set it and forget it" mentality, this examples shows that you can potentially increase your bottom line, without incurring any additional risk, by actively managing your hedging program.