3 min read

Fuel Price Risk Management & Three-Way Collars

As energy trading and risk management advisors, we regularly receive inquiries regarding if, when and how a company might hedge their exposure to...

3 min read

Mercatus Energy : Aug 15,2016

In the first two posts in our series our on bunker fuel hedging and price risk management, we explained how marine fuel consumers can utilize the two most common fuel oil hedging strategies, fixed price swaps and call options. Today we’re going to explore a strategy known as a collar, often a “costless” collar. While many often find the term collar to be confusing, the strategy isn't as complex as it might sound, as it simply the combination of buying one option (in the case of a fuel consumer, a call option) and selling another option (in this case, a put option) to create a price ceiling (also known as a max or maximum) and floor (as known as a min or minimum).

As an example, let’s assume that you’re a tug and barge operator in Southeast Asia looking to hedge your bunker who needs to have a known, maximum bunker fuel price over a given period of time, say the month of September. In addition, you need to be able to benefit, at least to some extent, from lower prices if bunker fuel prices decline. As such you decided to hedge with a "consumer costless collar", which is the combination of purchasing a call option on bunker fuel and selling a put option on bunker fuel. To make the option costless, the options will be structured so that the premium of the purchased call option is completely offset by the premium of the sold put option, hence the term costless.

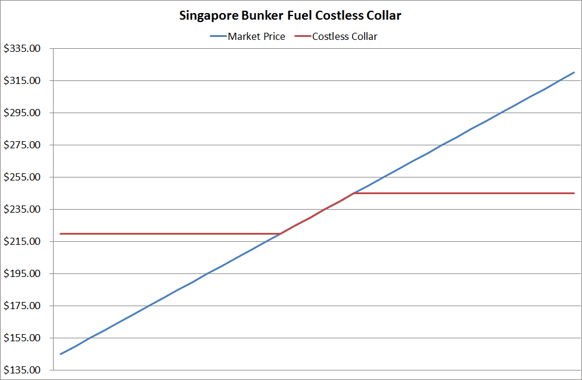

To put it into numerical context, let’s make the assumption that you need to ensure that bunker fuel cost during the month of September does not exceed $250/MT in order to remain within your budget. As such you decide to buy a September, Singapore 380 CST fuel oil (often referred to as MOPS) call option with a strike price of $245/MT and a premium cost of $3.50/MT. In order to offset the cost of the $245 call option, you also sell a you sell a September, Singapore 380 CST fuel oil put option with a strike price of $220/MT for $3.50/MT. Given that the premiums for both options, the purchased call option and the sold put option, are the same, the collar is indeed costless.

By hedging your bunker fuel price risk with the $245/$220 costless collar, you will have a hedging gain if Singapore 380 CST fuel oil during the month of September averages more than $245/MT, while you will have hedging losses if Singapore 380 CST fuel oil during the month of September averages less than $220/MT. As an example, if the average price of Singapore 380 CST fuel oil in September is $275/MT, you will receive a payment (hedging gain) of $30/MT ($275 - $245 = $30) from your counterparty. On the other hand, if Singapore 380 CST fuel oil in September averages $200/MT, you will owe your counterparty a payment (hedging loss) of $20/MT ($220 - $200 = $20).

That being said, it is important to note that both your hedging gains and losses will be offset by your higher or lower physical fuel costs. For example, if September Singapore 380 CST fuel oil were to average $275/MT, your $30/MT hedging gain on the call option (ceiling) would decrease your net fuel cost, which would be approximately $275/MT (excluding basis, taxes, etc.), by $30/MT. On the contrary, if September Singapore 380 CST fuel oil were to average $200/MT, your $20/MT hedging loss on the put option (floor) would increase your net fuel cost, which would be approximately $200/MT (excluding basis, taxes, etc.), by $20/MT.

What happens if Singapore 380 CST fuel oil averages between your floor of $220/MT and your ceiling of $245/MT during September? As both of your call option (ceiling) and put option (floor) will be out-of-the-money, you won’t have a hedging gain nor will you be subject to a hedging loss, your net cost will simply be the average price of Singapore 380 CST fuel oil during the month.

As this example shows, costless collars can be an attractive bunker fuel hedging strategy for companies in the maritime industry. However, given that one “leg” of the collar involves selling a put option, and selling options means taking on risk (in this case, a potential loss if Singapore bunker fuel trades below $220/MT), one must fully understand the risks associated with selling options before utilizing this or any other hedging strategy which involves the sale of options.

UPDATE: This article is the third in a series on bunker fuel hedging. The previous and subsequent articles can be found via the following links:

Bunker Fuel Hedging & Price Risk Management - Swaps

Bunker Fuel Hedging & Price Risk Management - Call Options

Bunker Fuel Hedging & Price Risk Management - Call Option Spreads

Bunker Fuel Hedging & Price Risk Management – Three-Way Collars

Editor’s Note: The post was originally published in December 2012 and has been updated to incorporate current market conditions.

3 min read

As energy trading and risk management advisors, we regularly receive inquiries regarding if, when and how a company might hedge their exposure to...

3 min read

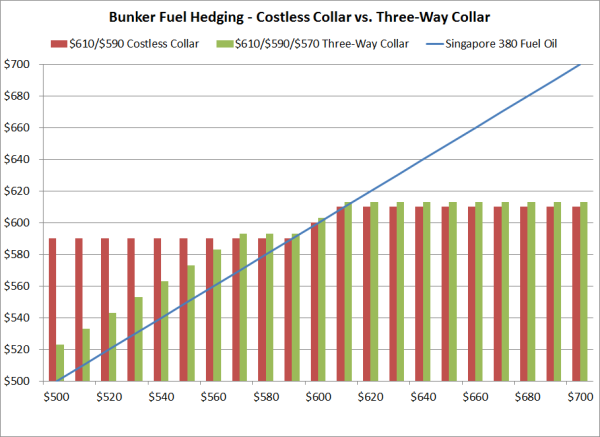

In recent weeks, we've spoken with many bunker fuel consumers (cruise lines, shipping companies, etc.) who are seeking "more creative" hedging...

3 min read

This post is the third in a series where are addressing the fuel hedging strategies most utilized by commercial and industrial fuel consumers. The...