Is Now An Ideal Time to Hedge Fuel Prices?

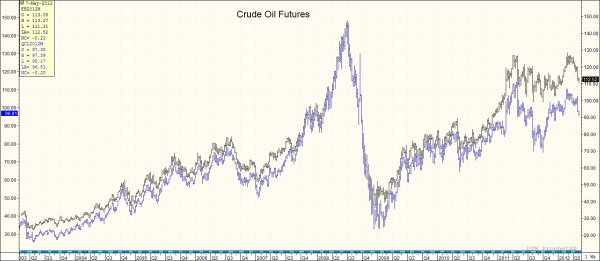

It was only a few weeks ago that many analysts were calling for crude oil to continue to trend towards $150 per barrel. Today many are saying that the trend seems to have reversed course and prices may very well be headed in the opposite direction. Earlier this week, the prompt month (June) Brent crude oil futures traded at their lowest level in since late January. Today, the prompt month WTI crude oil futures traded at their lowest level since mid December. Which has many wondering, are crude oil prices headed lower or is this simply a minor pullback amidst a longer term bull market?

For many large fuel consumers with active hedging programs, trying to predict where oil and fuel prices are going to be trading a month or year from now is one of their most difficult tasks, but this shouldn't be the case. Hedging decisions shouldn't be based on one's view of the market, as nearly all market participants are inevitably proven wrong, often in spectacular fashion (see this article on SemGroup for an example). If accurately forecasting oil prices were such a simple task, many of us would be earning a very nice living trading crude oil futures from the comfort of a luxurious beach home.

So if being able to accurately predict future oil prices isn't the key to a successful fuel hedging success, what is the key? In simple terms, sound risk management. If you were to buy a one year Brent crude oil swap today, how will it impact your bottom line if crude oil prices do indeed trend lower over the next year? Does locking in fuel costs at the equivalent of $110/BBL (or say, $3.00/gallon or $950/MT) allow you to lock in acceptable, or better yet, strong profit margins, regardless of where oil prices between now and next May? How would owning a $110 swap impact your cash flow if Brent averages $90 over the next year? Might it make sense to pay a $5/BBL premium to ensure that if prices do head higher than you will pay no more than $110/BBL but if prices move lower you will retain the ability to benefit from lower prices? After all, Brent has declined by $10/BBL in the last two weeks. Given the incredible amount of uncertainty in the oil markets, these are the types of questions that one must ask if the ultimate goal of your hedging program is hedging against oil price volatility.

What will happen to oil prices if the economic situation in the European union continues to deteriorate? What about an oil supply disruption in a large producing region such as the Middle East? What if US monetary policy causes the dollar to decline significantly? These are questions which need not be answered with precision if one is managing a sound fuel risk management program, as such a program will put you in a position to know how both higher and lower oil prices will impact your bottom line and cash flow, regardless of what variables are influencing the oil market. Clearly, reality isn't so simple but it can't be denied that fuel hedging programs which are successful over a long period of time aren't so as a result of outstanding commodity market knowledge but, the ability to make sound risk management decisions in various market conditions.