To Hedge or Not to Hedge Natural Gas At This Time?

The prompt month natural gas futures contract (April) settled yesterday at a ten year low, $2.281/MMbtu. The last time the prompt Henry Hub futures contract settled below $2.30 was February 25, 2002. It appears safe to say that mother nature has decided not to show her face this winter, at least in North American.

For natural gas consumers, this is good news, assuming they aren't locked into long term contracts at significantly higher levels. For natural gas producers, the news just seems to get worse the closer we get to the end of the heating season.

The reasons prices are so low are many but, at the end of the day, there is simply more supply than demand, despite the fact that many producers are shutting in (or at least have announced that they are going to) dry-gas production.

For those who follow the technical analysis, the technicals are also pointer to lower natural gas prices with support (per the April futures) pegged at $2.25, $2.00 and $1.90 while resistance is seen at $2.50, $2.65 and $2.75.

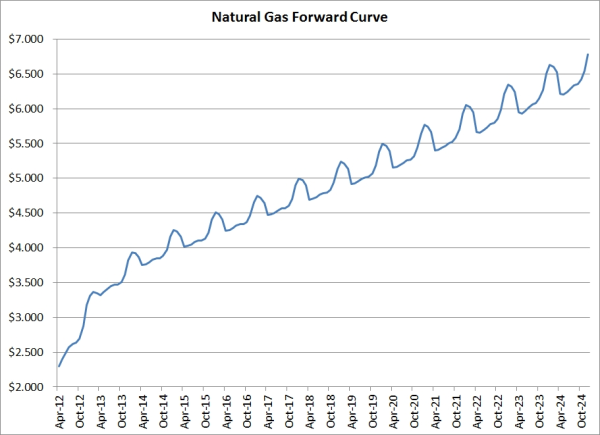

And it's not just the prompt month that has been pushed to such low levels. The one, two and three year strips finished the day at $2.808, $3.178 and $3.423, respectively. On a similar note, as of yesterday's close, we have to look to December 2014, December 2018 and January 2022, before we see $4.00, $5.00 and $6.00, respectively, on the forward curve. If we look all the way out to December 2024, the last month currently listed, prices are still trading below $7.00, settling yesterday at $6.778.

And so the questions remains, is now a good time to initiate a natural gas hedge? For many commercial and industrial consumers, it's probably safe to say that the answer is yes but, as always, it depends on your risk tolerance. If you execute a new hedge today, how will it impact your company if natural gas prices continue to trend lower and remain there for an extended period of time? Are you willing to "own" $2.75 natural gas in a $2.25 market? While 50 cents may seem trivial in a $10.00 market, it's 20% in a $2.50 market. While many end-users view options as an unnecessary expense, they can be quite attractive when prices are trading at such low levels.

For most natural gas producers, it's a much more difficult question as many producers simply can't break even at current market prices, a factor that will force many to shut in their production if prices don't rebound significantly and in short order. At $2.28, after you subtract finding, development and acquisition (FDA) costs, G&A (general & administrative) expenses, gathering, transportation, processing and royalties, there simply isn't much left, if anything, for the producer. For those who can somehow squeak out a profit based on current market prices, hedging (perhaps with put option spreads, as previously explained in this post: A Low Cost Natural Gas Hedging Strategy For E&P Companies) against further price declines probably deserves serious consideration, especially for those in the Midcontinent, where cash prices are quickly approaching $2.00/MMbtu.