2 min read

Fuel Hedging In Volatile Markets With Call Option Spreads

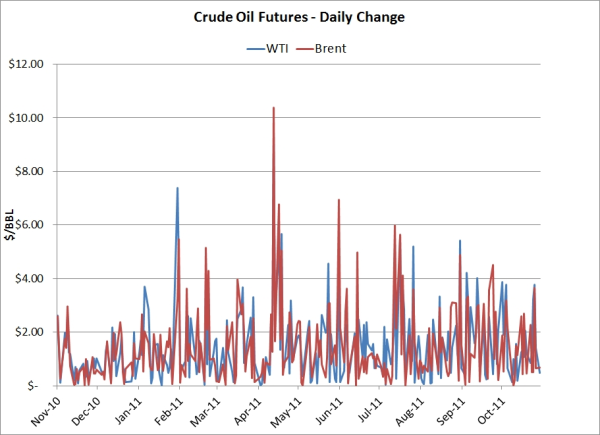

It can't be denied that the recent volatility in the oil and fuel markets is proving to be quite challenging for many companies with active hedging...

We've received several inquires about the article published last week on cfo.com, Is It Time to Hedge Against Oil Hikes?. More specifically, the inquirers wanted to know whether we think Monte Carlo simulations are a good tool to utilize when making fuel hedging decisions.

While Monte Carlo simulations and other quantitative models are often good weapons to have in your arsenal, if you don't have the primary building blocks in place, your hedging program is almost certain to fail at some point in time, even if luck and your Monte Carlo model are on your side in the short run.

To expand, we're strong advocates of quantitative analysis and often run numerous quantitative models as part of our research and analysis but, the most successful fuel hedging programs are, more often than not, a result of "keeping it simple." What we mean by this is that ensuring that you have all of the core building blocks (i.e. a sound risk management policy) in place is far more important than being a brilliant quantitative analyst or an "accurate" forecaster of oil prices, as all forecasters, regardless of whether they're human or machine, ultimately make an incorrect call on the market. And when they do, they're often painfully wrong.

That being said, with or without Monte Carlo, we would disagree with the opinion that it will be too expensive to buy a call option if oil is trading at $120/BBL (for what it's worth, Brent is already trading above $120/BBL), unless supported by numerous, additional factors, for several reasons:

So would we suggest that CFOs utilize Monte Carlo simulations when making fuel hedging decisions? Perhaps, but only if it's one of many tools used in the decision making process, not the least of which is an official fuel hedging policy, which dictates when and how such tools are to be utilized. Hopefully Kase shares this opinion.

Some might note that a Monte Carlo model would have likely triggered an "alert" when crude oil prices were approaching $150/BBL in 2008. It's quite likely but, a Monte Carlo model would have been equally likely to underestimate the probability of the move from $50 to 147 as well as the subsequent collapse from $147 to under $40. If Keynes were living today, perhaps he would have adapted his quote to something more like, "The market can remain irrational far longer than you, and your Monte Carlo models, can remain solvent..."

2 min read

It can't be denied that the recent volatility in the oil and fuel markets is proving to be quite challenging for many companies with active hedging...

3 min read

This post is the second in a series where we are explaining the most common fuel hedging strategies utilized by commercial and industrial fuel...

2 min read

What is a deferred premium option? Essentially, it is identical to a standard call or put option, except that the premium isn't paid until the...