Crude Oil Risk Management With Participating Swaps

At the request of one of our subscribers, this post addresses how E&P companies can hedge their crude oil price risk with participating swaps.

A producer participating swap is the combination of a fixed price swap and a call option. Many producers find this hedging strategy to be attractive because the call option provides the producer with upside participation should crude oil prices increase. However, rather than the producer paying for the call option upfront, which would be required with a typical call option, the premium is embedded into the price of the swap.An an example, let's assume that you are a crude oil producer looking to hedge your March production of 10,000 barrels. Let's further assume that you want to hedge 80% (or 8,000 BBLs) of your downside price risk while maintaining upside participation on 40% (4,000 BBLs) of your production. Last but not least let's assume that you are not willing to pay the upfront premium required of most options. As such you decide that an 8,000 BBL, 50% WTI participating swap is the strategy that best fits you needs.

Based on current market conditions, your counterparty (XYZ Financial Institution) quotes you an 8,000 BBL March 50% WTI participating swap at $98/BBL. They arrive at this price by taking the price of a March average price WTI swap of $100 (on 8,000 BBLs) and subtracting the current premium of a $100 March WTI average price call option of $4/BBL (on 4,000 BBLs), for a net cost of $2/BBL. In practice, they would also build in their cost of capital and profit margin but we're going to leave those aside to keep the math simple.

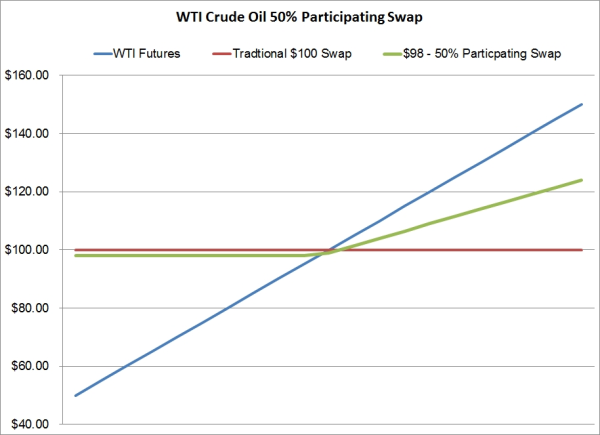

As the following chart indicates, if the front month WTI futures averages less than $98/BBL during the month of March, you will receive a payment from XYZ which equates to $98 minus the average price, multiplied by 8,000 BBLs. As an example, if the front month WTI futures during the month of March averages $90/BBL, you would receive a payment of $8/BBL or $64,000 ($8/BBL X 8,000 BBLs = $64,000) from XYZ.

On the contrary, if the front month WTI futures averages more than $98/BBL during the month of March, you will receive a payment from XYZ which equates to the average price minus $98, multiplied by 4,000 BBLs. As an example, if the front month WTI futures during the month of March averages $108/BBL, you would receive a payment of $10/BBL or $40,000 ($10/BBL X 4,000 BBLs = $40,000) from XYZ.

As a comparison, if you had simply hedged your March production by selling the $100 average price swap on 8,000/BBLs and the front month WTI futures averaged $90/BBL, you would receive a payment of $10/BBL or $80,000 from XYZ. On the other hand, if you sold the $100 average price swap on 8,000 BBLs and the front month WTI futures averaged $108/BBL, you would owe XYZ $8/BBL or $64,000.

As these examples show, participating producer swaps allow a producer to maintain a portion of the upside if crude oil prices increase while remaining "fully" hedged against declining prices. The trade off is that the price of the participating swap is less than the price of a "normal" swap as the cost of the call option (the participating component) is embedded into the price of the swap.