A "Zero Cost" Gasoline Hedging Strategy For End-Users

Given that more and more organizations with large fleets are seeking "low" or "zero" cost gasoline hedging strategies, which won't leave them completely locked into high gasoline prices, should gasoline prices decline, we thought we would explain a hedging strategy which we rarely here mentioned in the market, participating swaps.

In short, a consumer participating swap is the combination of a fixed price swap and a put option. What makes a participating swap unique is that rather the purchaser of the option paying the premium for the put option, the premium is added to the price of a fixed price swap.

As an example, let's assume that you're the CFO of a company with 1,000 vehicles which consume an average of 2500 gallons per year or a total of 2.5 million gallons per year. Let's further assume the following:

- Your fuel hedging policy states that you are required to hedge 80% of your anticipated gasoline consumption, which equates to 2 million gallons per year.

- While you are required to hedge your exposure to rising gasoline prices, you are also concerned that crude oil, as well as gasoline, prices could decline significantly due to weakening economic conditions.

- Your budget does not provide you with the capital to purchase gasoline call options (caps).

As a result of the above and a discussion with your fuel hedging consultant, you decide to hedge your gasoline price risk with a RBOB gasoline 50% participating swap. The participating swap is often more attractive than a traditional, fixed price swap because it overcomes the problem of forfeited participation in declining gasoline prices associated with a fixed price swap. By hedging with a participating swap, because of the swap component of the strategy, your fleet achieves complete price protection from any increase in gasoline prices. However, if gasoline prices decline, you will participate in 50% of the favorable price move if/when the average price of RBOB gasoline futures falls below the price of the swap.

As an example, let's assume that you purchase a $3.00 50% participating swap on 164,000 gallons (164,000 gallons per month X 12 = 2MM gallons per year) of NYMEX RBOB gasoline from ABC Financial Institution.

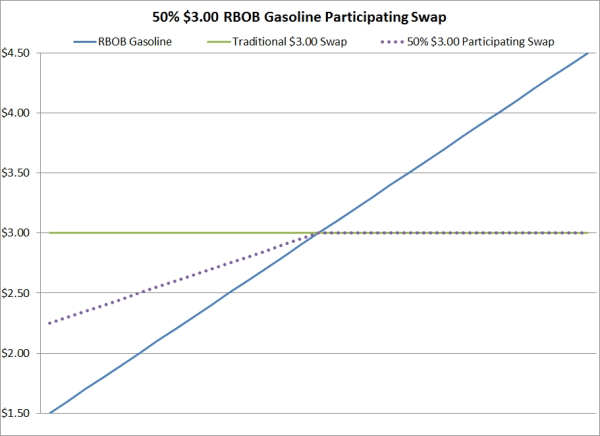

As the following chart shows, if RBOB gasoline averages more than $3.00/gallon, you will receive a payment equal to the average price, minus $3.00, multiplied by 164,000 gallons, from ABC Financial Institution. In effect, this means that if the average price is over $3.00, you net cost will remain $3.00/gallon.

On the other hand, if RBOB gasoline averages below $3.00/gallon, you will receive a payment equal to $3.00, minus the average price, multiplied by 84,000 from ABC Financial Institution. In effect, this means that if the average price is below $3.00, you net cost will be $3.00 on 84,000 gallons (50% of 168,000 gallons) and the average price on the other 84,000 gallons (50% of 168,000 gallons).

As the example indicates, the participating swap is very similar to the combination of a fixed price swap and a put option. However, there is a distinct difference:

- If you were to purchase a fixed price swap on 168,000 gallons and a put option on 84,000 gallons, you would be required to pay an upfront premium of $0.18/gallon or $11,520 for the put option.

In essence, a 50% participating swap allows you to have your cake, and eat it too, at least on 50% of your hedged volume. Also, as is the case with most hedging strategies, this strategy isn't limited to gasoline consumers. You can also hedge crude oil, diesel fuel, jet fuel, natural gas, etc. with participating swaps. Similarly, participating swaps can also be structured for oil and gas producers (or anyone with a similar risk profile), which would allow them to participate if prices increase, while also being fully protected against potentially declining prices.

Last but not least, it should be noted, if you were to purchase a traditional fixed price swap, the swap price (at least in this example) would be $2.82 ($3.00 - $0.18) but, you would not receive the benefit of lower prices, should gasoline prices decline.