2 min read

Is There Such A Thing As A Cheap, Low Risk Fuel Hedging Strategy?

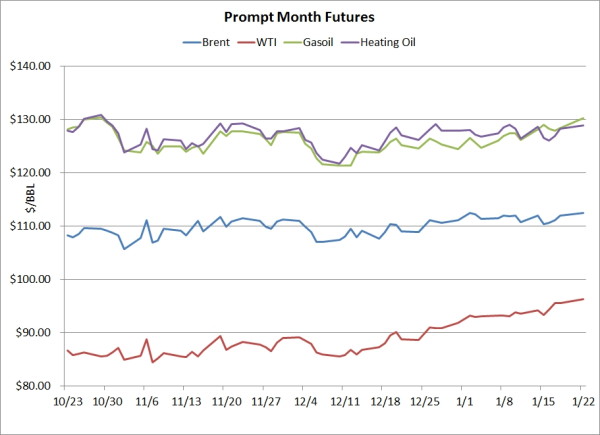

Over the course of the past three months, the prompt month Brent, WTI, gasoil and heating oil futures have averaged daily changes of $1.02/BBL,...

As many airlines are struggling to manage their exposure to volatile jet fuel prices, not to mention their ongoing struggles to turn a profit, one fuel hedging strategy which is rarely utilized but, could be considered by many airlines, is a consumer four-way collar. The strategy could be attractive to many airlines because it provides a partial hedge against rising fuel prices, limits exposure to declining prices and requires a minimal to no upfront premium cost.

In short, a four-way consumer collar is a combination of a long call option spread (also known as a bull call spread) and a short put option spread (also known as a bear put spread). To execute the call option spread, the airline would purchase one call option while selling a second call option which is further out-of-the-money (higher strike price) than the first call option. Similarly, the put option spread would be executed via the sale of one put option combined with the purchase of another put which which is further out-of-the-money (lower strike price) than the first put option.

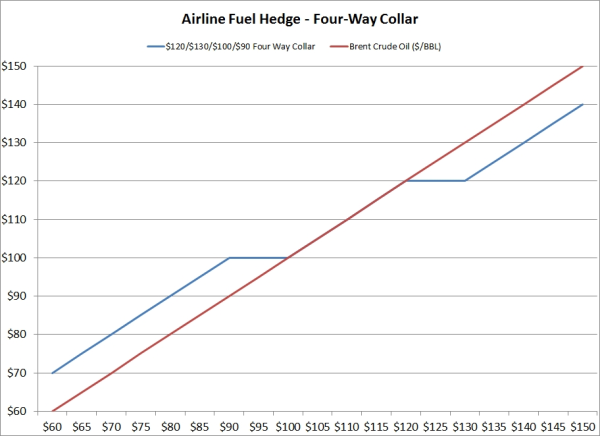

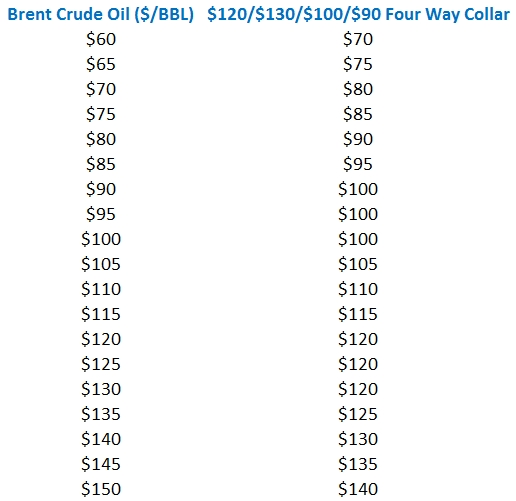

To put this strategy into numerical context, let's assume that a global airline has decided to hedge their March '12 fuel exposure with a four-way consumer collar using average price options on Brent crude oil. Let's further assume that the airline has determined that their most significant risk is between $120 and $130 per barrel. As a result, the airline purchases a $120 March Brent crude oil average price call option at the current price of $2.11/BBL. In addition, the airline sells a $130 March Brent crude oil average price call option at the current price of $0.79/BBL. As a result the airline is long a $120/call option and short a $130 call option, which provides it with protection if March Brent crude oil averages above $120/BBL but below $130/BBL, at a net cost of $1.32/BBL ($2.11-$0.79). If Brent averages above $130/BBL the airline's maximum gain on the hedge is $10/BBL ($130-$120).

To offset the cost of the call option spread, the airline also decides to sell a put option spread. As a result of the airline's internal analysis, they determine that put option spread should have strikes of $100/BBL and $90/BBL. As a result, they sell a March Brent crude oil average price put option at $100/BBL for $2.22/BBL and purchase a March Brent crude oil average price call option at $90/BBL for the current price of $0.90/BBL, at a net gain of $1.32/BBL ($2.22-$0.90). The combination of the short $100 put option and the long $90 put option means that the airline is at risk if March Brent crude oil averages between $90 and $100/BBL. However March Brent crude averages less than $90/BBL, the airline's maximum loss is $10/BBL ($100-$90).

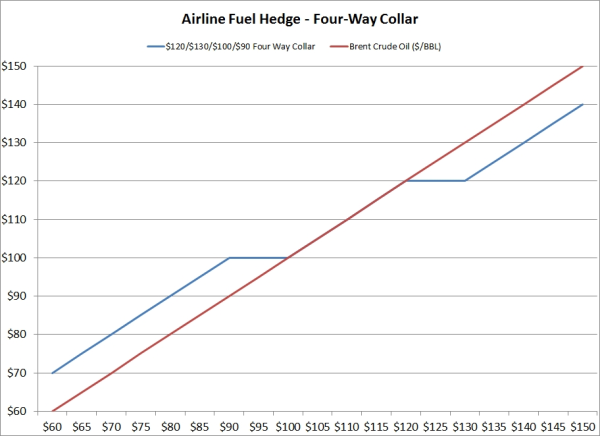

As the following graph and chart shows, the airline is hedged between $120 and $130/BBL, unhedged between $100 and $120/BBL and at risk between $100 and $90/BBL. If Brent prices average above $130/BBL, the airlines net cost will be the market price minus $10/BBL due to the $10/BBL gain on the $120/$130 call spread. Similarly, if Brent averages less than $90/BBL, the airlines net cost will be the market price plus $10/BBL due to the $10/BBL loss on the $90/$100 put spread. Last but not least, if Brent prices average between $100 and $120/BBL, the airline's net cost will be the market price as all of the options will be out-of-the-money.

While hedging with four-way collars isn't an ideal strategy for every company, for companies seeking a fuel hedging strategy which provides low to no cost, limited protection as well as minimal downside exposure, four-way collars might be the answer. Last but not least, this strategy isn't limited to airlines, it can also be utilized by consumers of diesel fuel, fuel oil, gasoline, natural gas, etc.

2 min read

Over the course of the past three months, the prompt month Brent, WTI, gasoil and heating oil futures have averaged daily changes of $1.02/BBL,...

3 min read

This post is the third in a series where are addressing the fuel hedging strategies most utilized by commercial and industrial fuel consumers. The...

2 min read

As the energy markets continue to evolve, NYMEX and ICE continue to introduce new contracts to accommodate the changing marketplace. As such, we...