3 min read

Can Activity in Crude Oil Options Provide Insight into Crude Oil Price Trends?

In a recent Bloomberg article, “In a Risky World, Oil Traders Bet on $100 a Barrel” the author explored how, “Some oil traders have started to gear...

While most oil market participants are focusing on Iran, Petrolplus and numerous other macro and micro variables, many are missing the elephant in the room, the reweighting of the S&P Goldman Sachs Commodity Index and the Dow Jones-UBS Commodity Index, the top global commodity indexes. While both are simply indexes, and as such they don't actually initiate trades, they are tracked by numerous ETFs (exchange traded funds) and other index tracking vehicles who seek to mimic or track the performance of the indexes.

So what do the reweightings mean for oil markets and, more importantly, those that hedge with WTI and Brent? Over the course of the week, the S&P GSCI Index, will reduce it's allocation in WTI crude oil from 32.6% to 30.25% while increasing it's allocation to Brent crude oil from 15.9% to 17.35%. More interestingly, the DJ-UBS index is going to include Brent crude oil for the first time ever with a weighting of 5% while reducing it's weighting of WTI from 15 to 9.7%. With an estimated $100 billion tracking the S&P GSCI and another $80 billion tracking the DJ-UBS index, based on current oil prices, this could mean somewhere in the neighborhood of 6.37 million barrels of WTI contracts being sold and 48.4 million barrels of Brent being purchased.

While these volumes may not seem significant relative to daily trading volumes of both WTI and Brent, the impact the reweightings will have on open interest is more significant. Approximately 4.5% of the WTI contracts held by the ETFs and funds tracking the two indexes will be sold over the course of the week while about 5% of the open interest in ICE Brent will be purchased during the same time frame.

While one might imagine that "front-running" the reweightings is an easy, profitable trade, the price action over on Sunday night and yesterday shows that that isn't quite the case as there are thousands of traders who have known about the reweightings since November. As the following chart shows, the spread between prompt Brent and WTI traded as high as $12.27/BBL Sunday night, before falling to as low as $10.85/BBL near the close of open outcry trading yesterday.

Ultimately, for those hedging with WTI and Brent, events such as the index reweightings make it clear that in order to properly manage an oil hedging program, one must follow the markets and analyze how various market scenarios might impact your hedge portfolio and act, or not act, accordingly.

3 min read

In a recent Bloomberg article, “In a Risky World, Oil Traders Bet on $100 a Barrel” the author explored how, “Some oil traders have started to gear...

2 min read

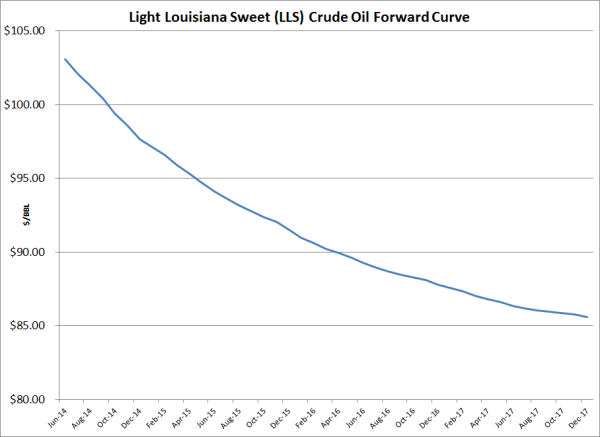

As the Gulf Coast continues to becoming an ever more active crude oil trading hub, the interest in hedging Gulf Coast crude oil is increasing as...

2 min read

As we discussed A Beginner's Guide to Crude Oil Options - Part I & Part II, there are four primary factors that determine the price of crude oil, as...