Natural Gas - Highlights Of The Year In Review

On Friday the EIA released their 2010 Natural Gas Year In Review, the agency's annual report on the natural gas market. A few of the highlights:

- Onshore marketed production increased from 51.5 Bcf/day to 54.6 bcf/day, year over year.

- Offshore marketed production decreased from 6.7 Bcf/day to 6.2 Bcf/day, year over year.

- Demand increased to 66.0 Bcf/day, with large gains coming from natural gas-fired power plants.

- Industrial natural gas demand increased to 18.1 Bcf/day from 16.9 Bcf/day, year over year. The 5-year average is 17.9 Bcf/day.

- Net imports decreased by 0.2 Bcf/day to 7.1 Bcf/day, the lowest net imports since 1994.

- Storage inventories reached 3,847 Bcf at the end of October, a new record level for the end of the injection season (April-October).

- Henry Hub prices increased to average $4.52 in 2010 vs $4.06 in 2009.

Given that the report is backward looking by nearly a year, here's our fifteen second summary of the current state of the domestic gas market as it relates to prices and hedging.

- The market continues to provide great hedging opportunities for end-users, not so much for producers.

- Over the course of the past six weeks, cash gas prices at Henry Hub have averaged $3.316.

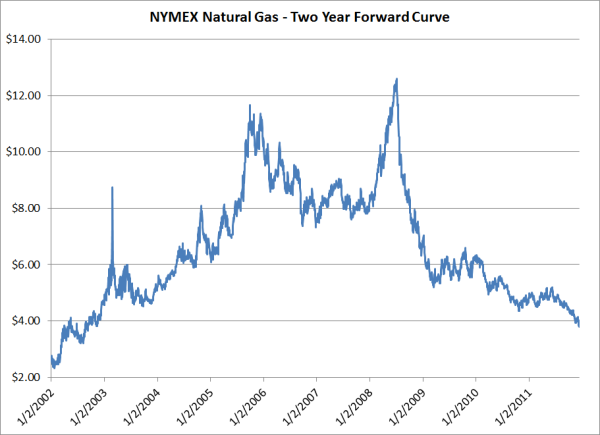

- Currently, the one and two year NYMEX natural gas forward curves are appoximately $3.48 and $3.80, respectively. The last time either traded below their current levels was 2002.

For those of you interested in perusing the EIA's entire report, you can access it via this link.

New to our blog? Check out the three most popular articles:

The Basics of Basis and Basis Risk

Hedging Oil & Gas With Three Way Collars

Fuel Hedging: A Competitive Analysis