Brent-WTI Crude Oil Spread Continues to Collapse

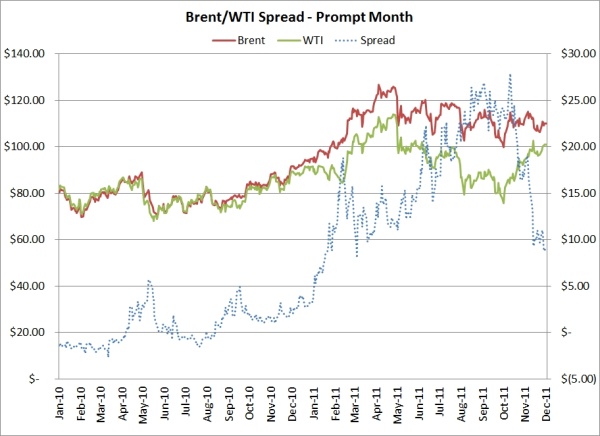

After topping out in October at $27.88/BBL, the Brent-WTI spread continues to collapse, settling yesterday at $8.82/BBL, the lowest level in nearly a year, excluding a single day in October.

Taking a step back, let's look at what caused the spread to widen in the first place. Over the past year, increasing volumes of crude oil being produced in Canada and North Dakota (Bakken) were being transported to the Mid-continent, including Cushing, the NYMEX WTI delivery point. This increasing supply simply wasn't be matched with adequate demand in the region, hence the decline in WTI prices, relative to Brent and other waterborne sourced crude oil.

So what's causing the price reversal? Last month, Enbridge and Enterprise, the owners of the Seaway pipeline, which transports oil from the Gulf Coast to Cushing, announced that they are going to reverse flow of the pipeline to run from Cushing to the Gulf Coast, beginning as early as second quarter of 2012.

Market participants see the flow reversal as alleviating the transportation bottleneck between Mid-continent crude supplies and Gulf Coast refineries. Following the announcement of the pending reversal, the difference between Brent and WTI prompt month futures has reversed nearly @20/BBL in less than two months. And it's not just the front of the curve, the December 2012 Brent-WTI spread has declined from just over $19/BBL in early September to $6.67/BBL yesterday.

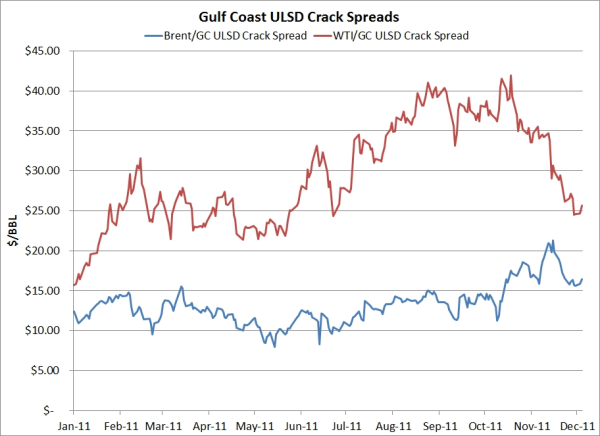

Looking at another from angle, why is the demand for crude oil stronger in the Gulf Coast than the Mid-continent? In short, because the Gulf Coast have more refining capacity and and the ability to export their refined products. Recall that the growing demand for refined products is in the developing world. As a result, if you're a refiner and you could get WTI barrels to the Gulf Coast, your profit margins would be significantly larger than if you have to refine import waterborne barrels, which track the higher priced Brent.

The following chart shows the WTI/Gulf Coast ultra low sulfur diesel (ULSD) crack spread (refining profit margins) vs. the Brent/Gulf Coast ultra low sulfur diesel (ULSD) crack spread. We compare these two as they are one of the best measures of the global oil markets as crude oil produced outside of the US and delivered to the Gulf Coast is often traded in relation to Brent. Clearly, there is a cost in transporting oil from the Mid-continent to the Gulf Coast but the fact the spread between the two hasn't been semi-static is evidence enough that the arbitrage play is alive and well.

While the announcement of the reversal has certainly changed the market's perception that Cushing barrels are landlocked barrels, it will be quite some time before the Mid-continent and the Bakken have enough take away capacity to bring the Brent-WTI spread back to or close to parity.