3 min read

The Fundamentals of NGL & LPG Hedging Part II - Options

This post, which explores hedging NGLs with options, is the second post in a series of several where explaining some of the most common NGL hedging...

This article is the third in a series covering the most common hedging strategies utilized by market participants in the NGL (propane, butane, ethane and natural gasoline) industry. The first article in the series, An Introduction to NGL Hedging Part I - Swaps, explained how an E&P company can utilize fixed price propane swaps to hedge their exposure to propane prices. The second post in the series, An Introduction to NGL Hedging Part II - Options, addressed how an industrial propane consumer can hedge their propane price risk with a strategy known as a call option.

While fixed price swaps and “long” option strategies, such as the consumer call option explained in the previous post, are the most “simple” hedging strategies which can be utilized by producers and consumers alike, in recent years a strategy named a collar, often a costless collar, has gained popularity with many NGL market participants.

While the term may come across as confusing, a collar is actually quite simple, as it is nothing more than the combination of buying one option (either a call or put) and selling the opposite type of option (either a put or call) to create a price ceiling and price floor.

As an example, if you are an oil and gas producer looking to hedge your propane price exposure, you might decide to hedge with a "producer costless collar". A producer costless collar entails the purchase of a put option and the sale of a call option whereby the put option provides a price floor and the call option provides a price ceiling. To make the option costless, the collar is structured so that the premium of the purchased put option is completely offset by the premium of the sold call option.

On the other hand, if you are a propane consumer looking to hedge your propane price exposure, you could hedge with a "consumer costless collar". As you might imagine, a consumer costless collar is the opposite of a producer costless collar. As such, a consumer costless collar entails the purchase of a call option and the sale of a put option. Also similar to the producer costless collar, the collar is structured so that the premium of the purchased call option is completely offset by the premium of the sold put option.

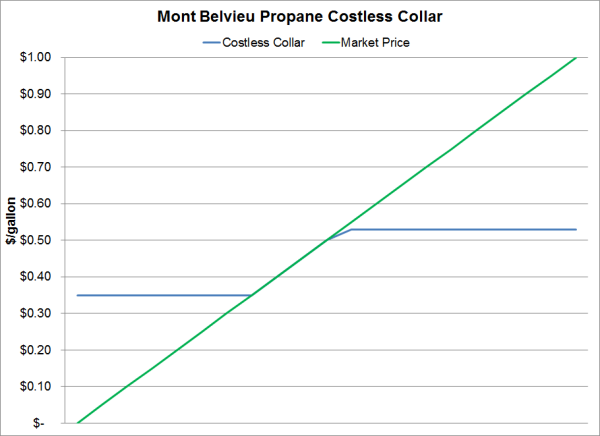

To put the costless collar strategy it into a numerical context, let's assume that you’re an oil and gas producer looking to hedge your December propane production with a costless collar. Further assume that after discussing the strategy with your colleagues, you determine that you want to be hedged against propane prices declining below $0.35/gallon and as a result, you buy a December Mont Belvieu propane put option with a strike price of $0.35/gallon for a premium of $0.0250/gallon. In order to offset the premium cost of the $0.35 put option, you also sell a December Mont Belvieu propane put option with a strike price of $0.53/gallon for a premium of $0.0250/gallon.

As a result of the $0.35/$0.53 costless collar, you are hedged against December Mont Belvieu propane prices averaging less than $0.35/gallon and exposed if December Mont Belvieu propane prices rise above $0.53/gallon. To expand, if December propane prices were to average $0.25/gallon, you would receive a payment of 0.10/gallon from your counterparty. On the other hand, if December propane prices were to average $0.60/gallon, you will owe your counterparty $0.07/gallon. Lastly, if December propane prices were to average more than $0.35/gallon but less than $0.53/gallon, you will incur neither a hedging gain nor a hedging loss; you will simply be exposed to, and receive, the average price during the month of December.

As this example shows, collars can be an effective NGL hedging strategy but due to the fact that one "leg" of the collar involves selling an option, and selling options equates to taking on risk, one must fully understand the potential consequences of being short an in-the-money option before hedging with a collar, costless or not. Furthermore, while this example explains how oil and gas producers can hedge with collars, consumers can hedge with collars as well; the structure and risks would simply be the opposite of those in the producer collar. Last but not least, collars are generally most advantageous to producers during times of "high" prices while most advantageous to energy consumers in "low" price environments.

If you would like to discuss how we can assist you with this or any other NGL hedging strategies, please to contact us and we can discuss your specific situation.

Editor’s Note: The post was originally published in December 2011 and has recently been updated to better reflect current market conditions.

3 min read

This post, which explores hedging NGLs with options, is the second post in a series of several where explaining some of the most common NGL hedging...

2 min read

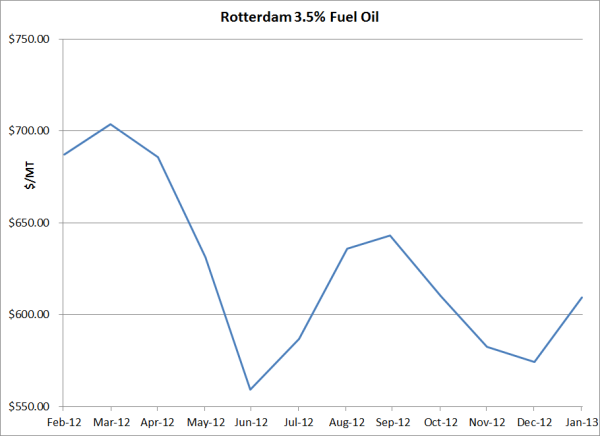

This post is the fourth in a series on hedging bunker fuel price risk. The first post in the series, An Introduction to Bunker Fuel Hedging,...

4 min read

This post is the third in a series where we are exploring how oil and gas producers can hedge their exposure to crude oil, natural gas and NGL...