3 min read

The Fundamentals of NGL & LPG Hedging Part III - Collars

This article is the third in a series covering the most common hedging strategies utilized by market participants in the NGL (propane, butane, ethane...

This post, which explores hedging NGLs with options, is the second post in a series of several where explaining some of the most common NGL hedging strategies. If you missed the first post you can access it via the following link: An Introduction to NGL Hedging Part I - Swaps. In subsequent posts in this series, we will also be exploring some of the more advanced NGL hedging strategies such as costless collars and three-way collars.

An option is commodity contract which provides the buyer of the contract the right, but not the obligation, to purchase or sell a particular amount of a specific commodity (such as propane, ethane, crude oil or natural gas) on or before a specific date or period of time.

There are two primary types of options; call options (also known as a ceilings or caps) and put options (also known as floors). A call option provides the buyer of the option with a hedge against a potential price increase. Conversely, a put option provides the buyer of the option with a hedge against a potential price decrease.

E&P companies often utilize put options to mitigate their exposure to lower NGL prices. On the other hand, NGL consumers often utilize call options to mitigate their exposure to potentially higher NGL prices.

As an example let’s examine how an industrial propane consumer can hedge their exposure to propane prices with a call option. For sake of simplicity, let's assume that you are looking to hedge your January forecasted propane consumption of approximately 5,000 barrels. As US propane is priced in dollars per gallon you will need to convert your 5,000 barrels to 210,000 gallons (1 barrel = 42 gallons).

Let’s further assume that you are looking to purchase a near-the-money call option as you want your hedge to be close to the current forward price for January Mont Belvieu propane. In order to accomplish this you could purchase a January Mont Belvieu average price call option from one of your counterparties. Let's assume that the current forward price for January Mont Belvieu propane is $0.44/gallon (as of the close of business yesterday it was $0.43375/gallon). If you had purchased a January Mont Belvieu propane call option with a strike price of $0.44/gallon at the close of business yesterday, your premium cost would have been approximately $0.06/gallon.

Let’s now analyze how this put option would impact your January propane costs if Mont Belvieu propane prices are both higher and lower than your strike price of $0.44/gallon when the option settles at the end of January.

In the first case, let's assume that Mont Belvieu propane prices have increased and that the average price for Mont Belvieu propane for each business day during January is $0.60/gallon. In this case, your call option would result in a hedging gain of $0.16/gallon ($0.60-$0.44=$0.16) or $33,600 ($0.1600 X 210,000 gallons). As a result, you would receive a payment of $33,600 from your counterparty, which would offset the higher price you would pay your propane supplier for the propane you consume in in January. Last but not least, given that you paid $0.06/gallon for the option, your net gain on the position would be $0.10/gallon ($0.16 - $0.06).

In the second case, let's assume that Mont Belvieu propane prices have decreased and that the average price for Mont Belvieu propane for each business day during January is $0.25/gallon. In this case, your call option would result not result in a hedging gain or loss as the option would expire out-of-the-money since the settlement price ($0.25) is lower than your strike price of $0.44. As a result, you would neither receive a payment from, nor owe a payment to, your counterparty. In addition, because the option settled out-of-the-money, you will enjoy the lower price of $0.25/gallon for the propane you consume in in January. However, because you had to pay $0.06/gallon for the option, your net cost for propane in January (excluding the basis differential, transportation fees and your supplier’s profit margin) would be $0.31/gallon ($0.25+$0.06=$0.31).

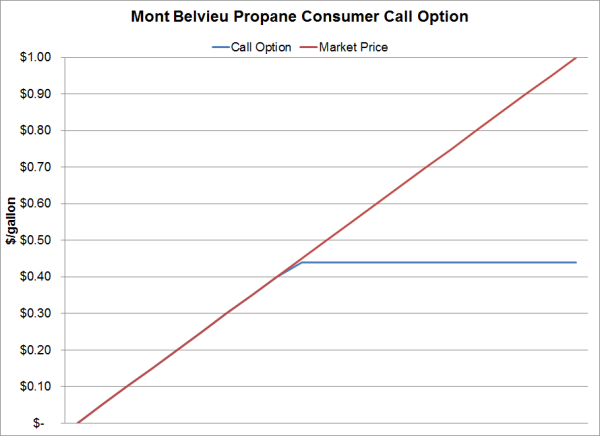

The graph above shows the "profile" of the $0.44 Mont Belvieu propane call option as described in the example. As the graph shows, if the price of Mont Belvieu in January averages $0.44 or more, your cost is capped at $0.44/gallon (excluding the option premium, basis differential, transportation fees and your supplier’s profit margin). On the other hand, if the price of Mont Belvieu in January averages less than $0.44, your cost will be the equivalent of the average price of Mont Belvieu in January (again excluding the option premium, basis differential, transportation fees and your supplier’s profit margin).

As this example indicates, propane consumers can have the best of both worlds – protection against higher prices and participation in lower prices – if they choose to hedge their propane price exposure by purchasing call options. Conversely, propane producers can have the best of both worlds – protection against lower prices and participation in higher prices – if they choose to hedge by purchasing put options. In the next post in this series we'll examine a more advanced hedging strategy known as a costless collar.

This article is the second in a series on common NGL hedging strategies. The previous and subsequent articles can be found via the following links:

An Introduction to NGL Hedging Part I - Swaps

An Introduction to NGL Hedging Part III - Collars

Editor’s Note: The post was originally published in December 2011 and has recently been updated to better reflect current market conditions.

3 min read

This article is the third in a series covering the most common hedging strategies utilized by market participants in the NGL (propane, butane, ethane...

4 min read

This post is the third in a series where we are exploring how oil and gas producers can hedge their exposure to crude oil, natural gas and NGL...

3 min read

As the NGL (natural gas liquids) & LPG (liquefied petroleum gas) markets around the world continue to grow – and will do so for years to come - many...