Hedging Crude Oil Via Deferred Cost Floors

Since bottoming near $77/BBL in early October, the 2012 WTI calendar strip has increased by more than $20 a barrel, trading as high as $101 in mid November. As a result, many crude oil producers who aren't well hedged, or hedged at all, are once again thinking about developing a hedging program. While many of these producers are familiar with put options (also known as floors), they're often reluctant to use them as stand alone hedges due the upfront premium cost.

If your company finds itself in this situation yet you don't want to "give up your upside" by hedging with a collar or swap, you might consider a deferred premium put option. A deferred premium put option is very similar to a standard put option, except that the premium isn't paid until the expiration of the option. In essence, the seller of the deferred premium put option is also acting as a lender, whereby they finance the cost of the option.

As an example, assume that you're a crude oil producer who wants to hedge your May 2012 production by buying an average price put option (also known as Asian put option) on NYMEX WTI. If you lack the cash (or the willingness to part with your cash) but have a strong balance sheet, your bank (or another counterparty) might be able to provide you a deferred premium put option.

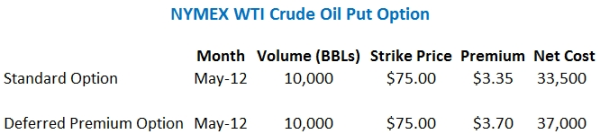

Let's further assume you have decided that you want to purchase a $75 May 2012 WTI average price put option and you receive a quote for a premium of $3.35/BBL. As previously mentioned, you don't want to pay for the premium upfront so you also ask for a quote on the same option, yet with the premium payment deferred until expiration, which is quoted at $3.70/BBL. At this point, you decide to purchase the deferred premium put for $3.70/BBL on 10,000 barrels.

Let's fast forward to May 31st, the last trading day of the May average price crude oil options. NYMEX WTI crude oil futures averaged $65.00/barrel during the month of May and as such your put option is "in the money" to the tune of $10/BBL. As such your counterparty owes you $10.00/BBL or $100,000 ($10.00/BBL X 10,000 barrels). However, because you purchased the deferred premium put option, with a premium of $3.70/BBL, you will receive a net payment of $6.30/BBL or $63,000 ($6.30/BBL X 10,000 barrels).

While you could have saved $0.35/BBL by paying for option at the time the trade was executed, paying an extra $.35/BBL allowed you to defer the cost by six month. Possibly a small price to pay for an oil producer that needs to spend every dollar they have on a drilling program but also isn't willing to give away much of their upside.

While this post explored how an E&P company can hedge crude oil via deferred premium put options, it's also possible to hedge gasoline, heating oil, natural gas and other commodities with deferred premium options, both call options and put options.

If you would like to discuss how we can help your company hedge with deferred premium options, please get in touch, we would be glad to work with you.