An Alternative Oil Hedging Strategy Using Three Way Collars

We've previously explored how both energy producers (see Hedging Oil Gas With Three Way Collars) and consumers (see Fuel Hedging With Three Way Collars) can hedge with a strategy known as a three-way collar. While these strategies have traditionally been comprised of the purchase of one option (a put in the case of a producer, a call in the case of a consumer) and the sale of two options (the sale of a call option and an additional put option in the case of a producer, a put and an additional call option in the case of a consumer), today we're going to address an alternative, three-way collar hedging strategy. The primary objectives of the alternative three-way collar is to minimize risk rather than improve strike prices, reduce premium costs or to generate cash flow (via the sale of the additional option), the objectives of the “traditional” three-way collar.

As the previously mentioned post regarding oil and gas producer hedging with three-way collars explains, oil and gas producers often hedge with a three-way collar strategy which involves the purchase one a put option (floor), the sale of a call option (ceiling) and the sale of an additional put option with a strike price below that of the original put option. Under this structure, the producer is exposed to potential losses if prices trade below the strike price of the additional put option.

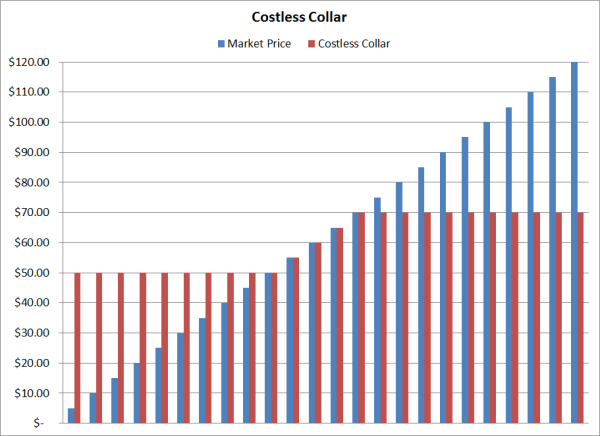

For an oil and gas producer who wants to hedge with a collar while also limiting the risk associated with the sale of the call option, an alternative, more conservative (less risky) three-way strategy would be to purchase an additional call option with a strike price which is higher than the strike price of the original call option. To put it into numerical context, let's assume that the producer is considering hedging crude oil with costless collar comprised of a floor (put option) at $50/BBL and a ceiling (call option) at $70/BBL. In this scenario, the producer is protected against prices trading below $50/BBL, unhedged between $50/BBL and $70/BBL and "at risk" if prices trade above $70/BBL.

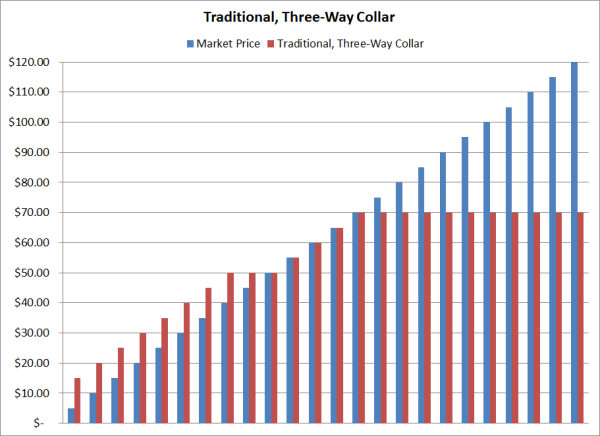

With a traditional three-way collar, the producer would also tend to sell an additional put option at, for example, with a strike price of $40/BBL and a premium of $1/BBL. Note that because the producer is selling the $40 put option they are receiving, rather than paying, the option premium of $1/BBL. Also, the strike price could be at any price below $50/BBL but for the purposes of this example we are using $40/BBL. While the sale of the $40 put option can improve the strike prices or lower the premium costs of the original collar positions, the sale of the $40 put option also creates risk as the producer will incur hedging losses if prices settle below $40/BBL.

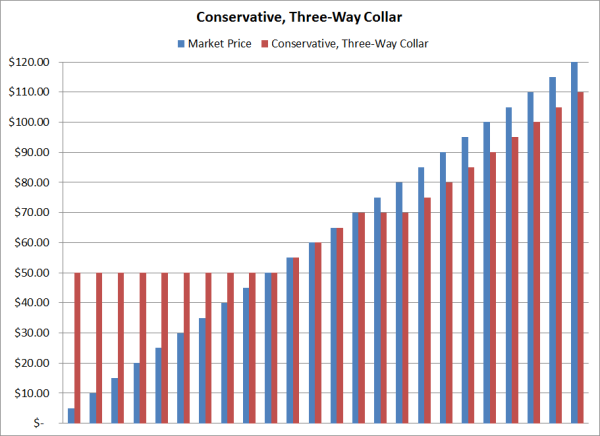

Under the alternative, more conservative three-way collar strategy, if the producer is concerned with the risk of being short (selling) the $70 call option, they can reduce their exposure (risk) by purchasing a further out of the money call option (ceiling), for example at $80/BBL. The purchase of the additional call option at $80/BBL will limit their risk to the $10/BBL as gains on the $80 call option will offset losses on the $70 call option, should prices trade above $80/BBL. For the sake of this example we’ll assume that the premium cost of the $80 call option is $1/BBL.

As the charts above indicate, the traditional, three-way collar provides the producer with a decent hedge when prices are moderate to high but with a less than ideal position if prices trade below $40/BBL or above $70/BBL. The conservative three-way collar provides the producer with a preferential scenario when prices are at nearly any price level, albeit with a small loss when prices trade above $70/BBL. Note that the charts includes the $1 premium received for the sale of the put option associated with the traditional, three-way collar and the $1 in premium paid for the additional call option associated with the conservative, three-way collar.

In summary, three-way collars can definitely be a sound hedging strategy but, as the examples indicate, some three-way hedging strategies involve a significant amount of risk while others insure that the risk is quite limited, regardless of market conditions. If you'd like to discuss how you can utilize collars (two, three or four-way) to hedge your energy price risk, give us a call, we'd be glad to work with you.

Editor’s Note: The post was originally published in October 2011 and has been updated to provide more information and better reflect current market conditions.