3 min read

An Introduction to Energy Basis, Basis Risk and Basis Hedging

Nearly every day our team spends a meaningful amount of time discussing basis differentials, basis risk and mitigating basis risk, yet basis is a...

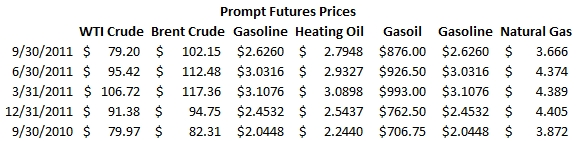

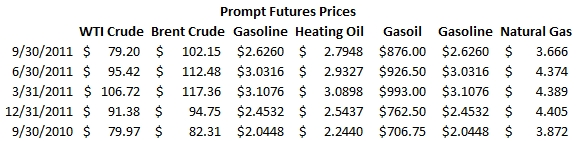

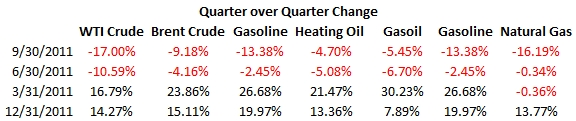

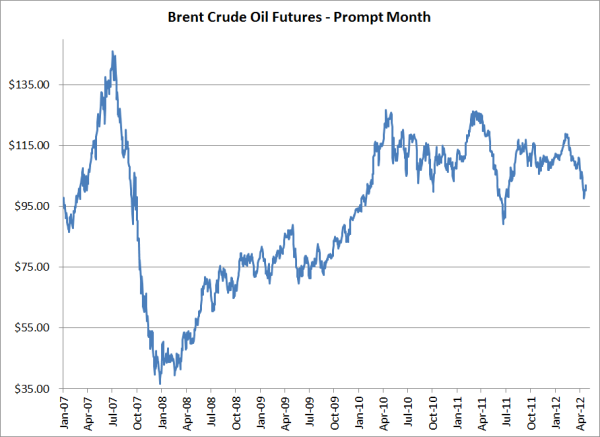

As the third quarter of 2011 draws to a close it's time to take a look at the energy price roller coaster of the past year, and a roller coaster it has been...

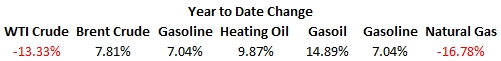

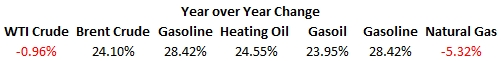

As the data indicates, and as we've been discussing non-stop over the past few months, Brent is in the drivers seat. While WTI is down 13.33% year to date and 0.96% since the close of Q3 2010, Brent is up 7.81% year to date and 24.1% since the close of Q3 2010. And as goes Brent, at least in the current environment, so goes refined products. Gasoil, heating oil and gasoline are up 14.89%, 9.87% and 7.04% year to date, and 23.95%, 24.55% and 28.42% year over year, respectively. That being said, it can't be ignored that the quarterly decline in WTI is the largest, quarterly decline in WTI futures since the bottom fell out in Q4 of 2008, a quarter which saw WTI prices decline by 56%.

Looking across the aisle, natural gas prices can't seem to find a floor. Great news for end-users but, not so much for natural gas producers. After finishing the 4th quarter of 2010 up 13.77%, and settling more or less flat in Q1 and Q2, prices tubmbled during the third quarter, down 16.19% since the close of Q2.

So where do we go from here? As far as crude and refined products go, it's probably best to ask the central bankers and politicians as the markets continue to react to nearly their every word. While emerging market growth continues to drive oil and fuel demand in much of the world, if the Europe and/or the U.S. stumbles, the BIC (Brazil, India and China), at least to some extent, be forced to follow suit. Natural gas? So long as E&P companies continue to drill and mother nature doesn't bring colder than normal temperatures, natural gas is likely to remain out of favor. Never ones to end on a sour note, here's to a great fourth quarter...

3 min read

Nearly every day our team spends a meaningful amount of time discussing basis differentials, basis risk and mitigating basis risk, yet basis is a...

2 min read

As has been the case many times in the past and certainly will be many times in the future, the debate regarding the advantages and disadvantages of...

1 min read

Without further ado, the following are our answers to your May energy hedging questions. As always, if you would like us to provide more depth or...