Special Update - Crude Oil, Refined Products & Natural Gas

We generally don't provide public "market commentary" but given the events of the past week and their impact on the energy markets, we thought we would provide a brief opinion on the current environment, specifically as it relates to energy prices.

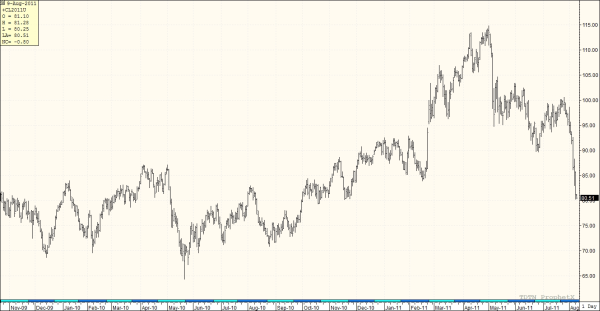

For starters, the prompt NYMEX crude oil futures (see chart below) posted a fresh low for 2011 today ($81.31/BBL), which is likely to keep the sharp downward trend alive for the time being. The same can probably be said for Brent crude, heating oil, gasoil and gasoline. ICE Brent crude oil traded at it's lowest level ($102.70/BBL) since February 14th, NYMEX heating oil closed at it's lowest level ($2.8017/Gal) since June 27th, ICE gasoil traded at it's lowest level ($876.25/MT) since June 28th and NYMEX gasoline traded at it's lowest level ($2.6916/Gal) since February 22nd. In addition, all of the above "lows" have been taken out in after hours trading this evening. As of this moment, prompt NYMEX crude oil is down $2.03 to $79.28/BBL, heating oil is down $0.0277 to $2.7740/Gal, gasoline is down $0.0328 to $2.6588/Gal, ICE Brent crude oil is down $1.71 to $102.03/BBL and ICE gasoil is down $25.25 to $875.00/MT.

Today’s heavy selling (not only in energy but across the board) was largely attributed to the US credit downgrade issued by S&P on Friday night. On that note, we think there is a strong probability that there could still be a significant amount of “de-risking” (aka selling) across most assets classes (energy included) in the coming days, and potentially weeks, as a result of the US credit downgrade, the recent debt ceiling circus in Washington and what is beginning to look like a trend of disappointing economic news.

While this week’s economic calendar is comparatively light, the FOMC (Federal Reserve) is due to meet tomorrow which could prompt additional selling if their message isn’t positive. In addition, even minor reports such as tomorrow’s productivity and cost data from the BLS could prompt additional selling if they provide any negative surprises. The market will also be watching the EIA Short Term outlook and the monthly OPEC report, both due out tomorrow. We expect that both organizations will issue downward revisions to their global oil demand forecasts for the rest of 2011 and possibly beyond. Last but not least, the weekly EIA crude and products inventory report will be released, as it is every week, on Wednesday.

NYMEX Crude Oil Futures (Prompt Month)

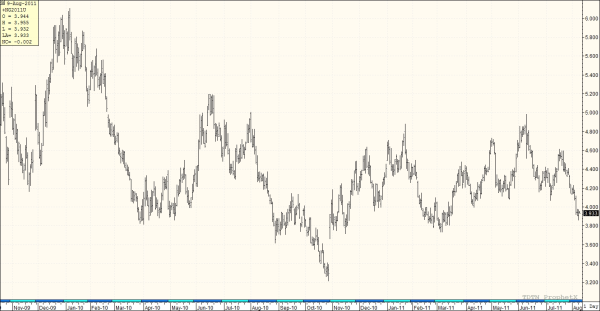

On the natural gas side, prompt month NYMEX futures (see chart below) ended the day relatively unchanged, despite the strong sell off in crude and products. That being said, today’s low of $3.855/MMBtu is the lowest print we’ve seen in prompt month natural gas futures since March 15th, a sign that the recent downward trend in natural gas is likely remain intact for now as well.

NYMEX Natural Gas Futures (Prompt Month)