October Energy Hedging Q&A - Crude Oil, Diesel Fuel & Propane

As a continuation of our September and August Energy Hedging Q&A posts, here are the questions and our answers to this months Energy Hedging Q&A. As always, if you would like us to provide a more in depth answer to any of these questions or if you’d like to ask us a question for next month’s Q&A, let us know.

We're a producer, primarily crude oil, and are in the process of making an acquisition. We need to hedge some or most of the acquisition barrels to guarantee that we can service the debt and meet our internal returns, what types of hedges should we use?

As is usually the case with questions like this, we need to know more details but here's our basic answer...For starters, you want to execute the hedge(s) associated with the acquisition based on the economics of the acquisition. Let's assume that you need to guarantee $50/BBL for the next 36 months to satisfy cash flow needs for debt service and to meet your internal return goals. Let's also assume that the PDP of the acquisition is 10,000 barrels per month, which means that over the next 36 months you need the acquisition to generate $18,000,000 in revenue.

Based on these assumptions, you could sell 6 NYMEX crude oil swaps (or futures) (6,000 barrels per month), based on the current 24 month strip price of $86.33/BBL. This would provide $18,647.280 in revenue over 24 months, while also providing you with 100% of the "upside" on the additional 4,000 barrels per month during the first two years and 100% of the "upside" on all 10,000 BPM during the third year.

You could also purchase a put option (floor) at any price level between the current strip price of $87/BBL and your requirement of $50/BBL. Another alternative would be to utilize a costless collar that includes a put option (floor) at $50/BBl or higher. In short, you need to employ a hedge(s) that in some way provides you with a guaranteed revenue of at least $18,000,000 over the next 36 months.

Clearly, these are generalizations (to provide a more accurate answer we would need to understand the economics of the acquisition, location of the wells so that we can analyze your basis risk, etc.) and there are dozens of ways to skin this cat but hopefully our answer provides you with a good, basic understanding of how you might go about hedging a crude oil acquisition.

I own a hauling business and want to hedge my exposure to diesel fuel prices. I've heard that I will have to hedge at least 42,000 gallons per month as that is the volume in a NYMEX heating oil contract, is this correct?

Generally speaking, your assumption is correct but there are a few market makers (hedge providers) that will sell swaps and options in quantities of less than 42,000 gallons (1,0000 barrels) per month. In the trading business these non-contract increment trades are called odd-lots. Furthermore, if you intend to hedge diesel fuel with heating oil futures, options or swaps, you will also be exposed to basis risk. This isn't to say that hedging diesel fuel with heating oil futures isn't recommended, sometimes it is and sometimes it isn't, but before that decision is made you need to quantify your basis risk and determine if you need/can hedge your basis risk as well. If we can assist you with this, please give is a call or send us an email via our contact page.

We're a propane marketer and are upside down on the fixed price programs we sold to our customers for this winter. I guess you could say that we bet that propane prices were going to come down this summer and they didn't. What should we do?

Unfortunately this is a common mistake in the retail propane business. For whatever reason, many propane marketers assume that they can predict future price movements. As you can imagine, there isn't an easy answer to this question. If you are willing to "lick you wounds," it's not too late to hedge your exposure. Sure, it will mean that your margins will be smaller than you had hoped but by hedging now you can ensure that your situation doesn't get worse from here. There are a number of ways you can mitigate/eliminate your risk including swaps, call options and collars as well as physical barrels, if you have storage or access to storage. The key is a willingness to "cry uncle" and minimize your losses or potential losses.

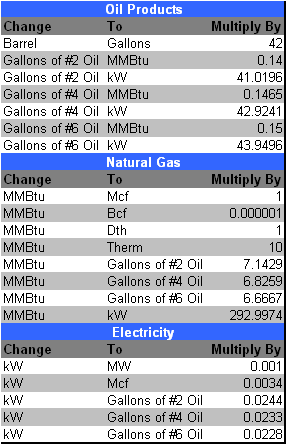

Where can we find a conversion chart that shows how to compare heating oil prices to natural gas prices and vice versa?

Hopefully the following chart will serve your needs. If not let us know and we'll try to come up with an alternative.

If you'd like to pose a question for next month's Q&A please leave a comment or send us an email.