Hedging Oil & Gas - Costless Collars vs Three-Way Collars

This post was originally written many years ago but has been updated many times since as it is regularly referenced by various publications and reports regarding crude oil and natural gas hedging, especially in the case of independent oil and gas producers, with three-way collars i.e. Oil Crash Exposes New Risks for U.S. Shale Drillers.

From the perspective of an oil and gas producer, a three-way collar generally involves the producer buying a put option and selling a call option, just as they would do with a traditional collar, to establish a floor price and ceiling (also known as a cap) price. An additional step, or leg as it is known in the trading world, is what differentiates traditional collars and three-way collars. In the case of an oil and gas producer hedging with collars, the difference between a traditional collar (often a “costless” collar as the premium paid for the put option is offset with premium received by selling the call option), and a three-way collar is that the three-way collar also involves the producer selling a further out-of-the-money put option (also known as a subfloor). The net premium of a three-way collar is determined by the sum of each option leg as well as numerous variables which we’ve highlighted in other posts such as The Laymen's Guide To Natural Gas Options.

So why do oil and gas producers often hedge with three-way collars? In essence a three-way collar can provide oil and gas producers with a "lower cost" - and in some cases, revenue positive – hedge structure due to the sale (short) of an additional, further out-of-the-money put option or subfloor. However, as is nearly always the case when it comes to hedging and markets, there is no free lunch.

In the case of a three-way collar involving the sale of an addition put option, the producer is also taking on additional risk, specifically the risk that prices will not decline and settle below the price of the subfloor as such a result will create a hedging loss for the producer. If you are interested in alternative hedging structures that utilize three-options, yet in a more conservative manner, see An Alternative Oil Hedging Strategy Using Three Way Collars.

As noted in the Bloomberg article mentioned above, some producers hedge with three-way collars because they are “sure” or “not concerned” about prices declining below a certain level i.e. the strike price of the second put option. Clearly, as evidenced by the various low-price environments we have witnessed over the years, taking such a view can be quite speculative in and of itself.

Natural Gas Hedging - Costless Collar vs. Three-Way Collar

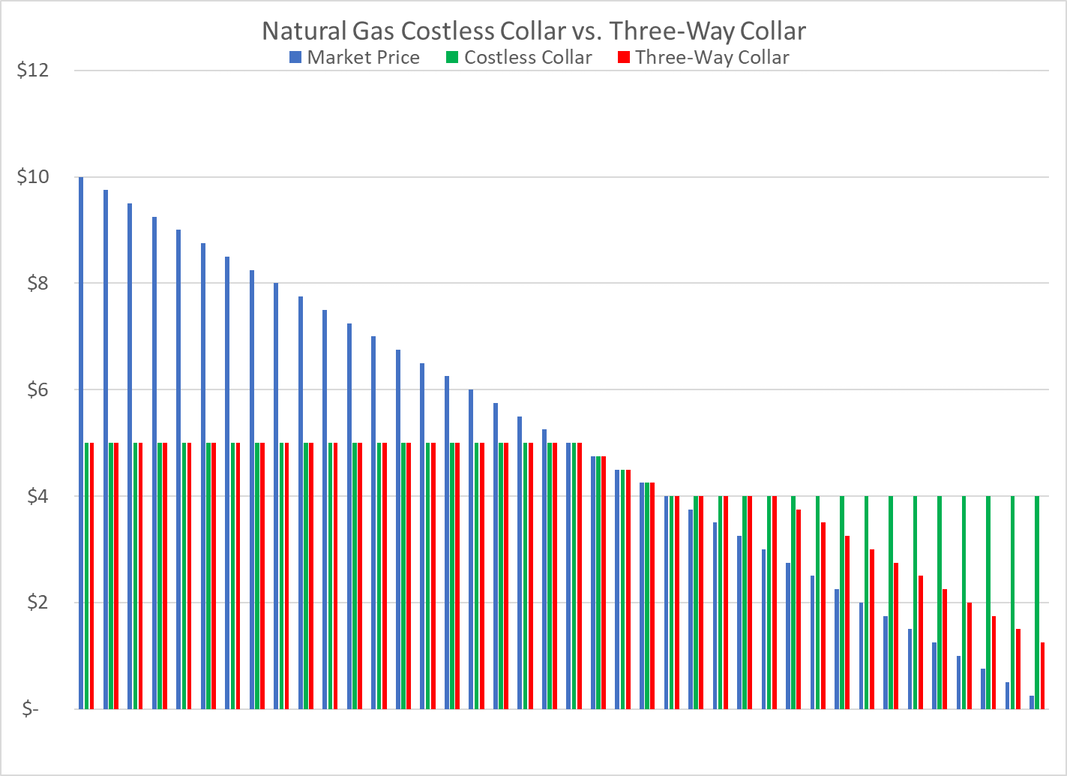

As an example, let's assume that during a time frame when U.S. natural gas futures prices (Henry Hub) were still moderately high, a natural gas producer had hedged their 2023 production with a three-way collar comprised of a short $5 call option, a long $4 put option and an additional, short $3 put option. The graph below indicates how this three-way collar, as well as a traditional, producer costless collar (utilizing the same $5 call option and $4 put option used in the three-way but without the additional $3 put option), would perform in various price environments.

As the chart indicates, a three-way collar can be an ideal strategy in some price environments but, when prices decline significantly, as they more than a few times in recent years, it’s far from an ideal hedging strategy.

So, can three-way collars be a sound hedging strategy for oil and gas producers? Yes, but the challenges faced by several of the producers highlighted in the Bloomberg article would suggest that it is indeed not often the case. However, in general, it's difficult to say until the options have expired. Often, when a producer hedges with a three-way collar of this sort, they are taking on additional, unnecessary exposure in exchange for what they perceive to be more advantageous strike prices or lower premium prices.

In summary, most producers that hedge with traditional three-way collars (short call, long put and short additional put) are often taking a punt on the short put position, turning their hedge into a rather speculative position. When initiating these strategies, many producers will claim that they "know" that prices won't decline enough for their short put position to move in-the-money.

However, as experience shows time and time again, that’s often not the case. Recall that many producers incurred large hedging losses from selling out-of-the-money put options, often as part of a three-way collar, nearly every time that there is a significant, lasting decline in crude oil and/or natural gas prices. Clearly many producers did not learn from the 2008-2009 collapse and are once again experiencing large hedging losses due to the recent price decline, many, once again, thanks to three-way collars which are short in-the-money put options.