Constructing a Hedging Matrix for Oil & Gas Producers

When meeting with potential clients one of the topics we always discuss is their risk tolerance as it relates to their risk profile, hedging goals and objectives, in-house resources (personnel, systems, etc.) financial condition, corporate culture, etc. and in the course of this discussion we often explore a hedging (risk management) matrix of sorts. Essentially it's an informal "road map" for what hedging instruments they might consider employing based on the previously mentioned variables (e.g. tolerance for risk) as well as the current market environment.

The matrix isn't intended to be used as "decision tool" but simply as another tool in the hedging and risk management tool box. If nothing else, it always spurs meaningful discussion as to what hedging instruments an oil and gas producer should consider in a specific market environment i.e. is the current forward curve for natural gas high or low relative to recent prices, historical prices and/or future expectations. To expand, if the forward curve for natural gas prices is considered to be "low", relatively speaking of course, should said producer employ puts, collars, swaps or another structure i.e. a three-way collar?

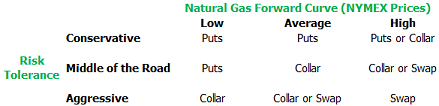

As an example, here's a generic hedging matrix that might be used by a natural gas producer. What this matrix is essentially showing is that if this natural gas producer has a low risk tolerance (conservative) and prices are low they should consider hedging with puts. On the other end of the spectrum, if said producer has a high risk tolerance (aggressive) and price are high, they should considering hedging with swaps.

This matrix is only a meant to serve as generic guide. You and/or your company should generate your own decision matrix based on your specific hedging goals and objectives, risk tolerance, financial condition, etc.

To clarify, we're not nor do we claim to be price forecasters or speculators, quite the contrary. Rather than attempting to forecast future prices, we approach it from the opposite perspective, determining whether it is in a client's best interest to implement a specific hedge position given all of the variable discussed above as well as the current market environment, which isn't just limited to the forward NYMEX curve but also basis and volatility, amongst numerous other factors.

In conclusion, if your company is having a difficult time determining which hedging instruments you should use in a given situation, perhaps you should consider building a hedging matrix to spur your risk management discussions. As always, if you'd like to discuss the hedging matrix or anything else please don't hesitate to contact us.