Natural Gas Hedging & Marketing in a $2.00/MMBtu & 4 TCF Market

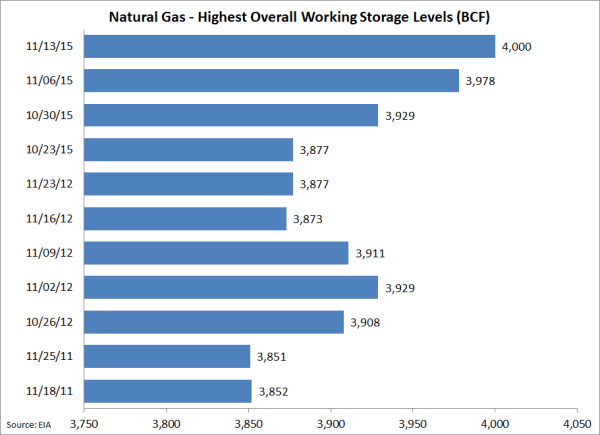

The EIA will release its weekly natural gas storage report tomorrow (one day early due to the Thanksgiving holiday) and it’s likely the agency will report another build. As most of you who follow the natural gas markets are well aware, storage levels reached an all-time high of 4 TCF (trillion cubic feet) for the week ending November 13, 2015 and given the moderate weather across most of the country last week, analysts are forecasting another build in tomorrow’s report.

The end of October has historically represented the market’s assumed end to injection season, but mild late fall/early winter weather and resilient production activity has resulted in continued storage builds. These later-than-normal builds come on the heels of a strong summer injection season. The EIA estimates a net injection of more than 2.5 Tcf since April 2015, with robust summer electricity demand keeping the net injection from matching last year’s record setting injection of approximately 2.78 Tcf. Still, production seems to be outpacing demand growth for another year, a trend that is not expected to abate in 2016. We don’t expect any of this comes as a surprise to our readers, who we assume are informed market participants. Our conversations indicate, however, there is some uncertainty about what it means for their natural gas hedge portfolios.

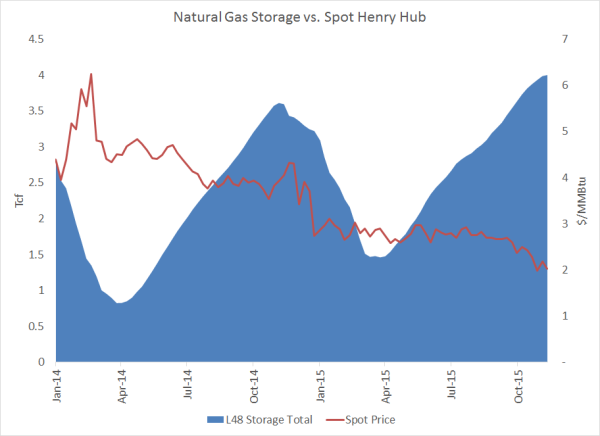

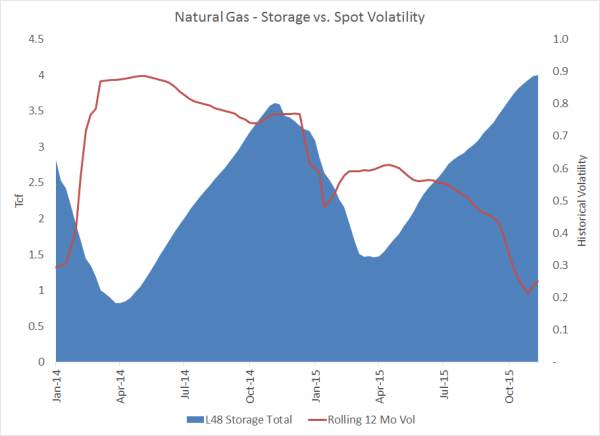

Fundamentally, a deep reserve of accessible natural gas relative to demand, via production growth and/or storage, impacts both prices and volatility. This can result in a muted price reaction to spikes in demand or, more likely, price spikes to address this demand will be short lived and will fail to ripple through forward curve. As expected, as storage levels have risen off of the 5-year lows observed through the summer of 2014, spot natural gas prices have fallen from around $3.50-4.00/MMBtu at Henry Hub to around $2.00, and at times trading slightly lower than $2.00. Similarly, since peaking in the second quarter of 2014, volatility has fallen as storage levels swelled.

In recent weeks, low natural gas prices have been in the headlines, with good reason. Considering the entire energy complex (crude oil, refined products, NGLs and natural gas) are currently trading near lows, producers are facing stressful times. It goes without saying that the current market is exposing producers’ weaknesses as it relates to hedging and marketing. In a $2.00 gas market, every penny counts. As such, producers have to determine whether they are capturing the maximum value for their molecules through efficient marketing and, to the extent possible, optimized forward price management. Second, they have to take what the market gives them, for better or worse.

Our work indicates many producers are, understandably, struggling to make hedging decisions for 2016 and beyond. They may have captured large hedging gains in 2015, but are naked or under hedged for 2016 and beyond. It is unlikely that many producers will want to sell natural gas swaps at $2.00/MMBtu. Still, remaining naked is clearly a dangerous strategy as prices can and likely will fall further, at least for brief periods that may unfortunately coincide with a producer’s gas pricing window i.e. bid week. With low volatility and low prices, there are likely to be opportunities to hedge with an options strategy within budget – puts, put spreads, and three-way collars (long put, short call, long additional call). All three of these strategies can be optimized, offer participation in a rising price environment, and none require significant credit/margin.

In a $2.00 market most producers tend to focus their efforts on maximizing their physical marketing and while it is certainly important to do so, spending time determine if, how and when to optimize their hedge portfolios is equally as important. In addition, entering into new positions at the right time and right price levels – to the extent that such a thing exists in a $2.00 market – makes optimization easier and less expensive, not to mention allows you to avoid margin calls, portfolio churn, etc.

Consumers take note. On numerous occasions in the past we’ve published “warning messages” regarding how end-users can avoid making similar hedging mistakes as many producers did when crude oil and natural prices were trading at much higher levels. While some have heeded our advice, others fancy themselves price prophets. A low volatility, low price market is an ideal market for end-user hedging as low cost, conservative strategies (call options, call spreads and three-way collars) are readily available. For some end-users, purchasing swaps at the current price levels may be the strategy of choice, after all it has been quite some time since we have seen such a prolonged, low gas price environment.

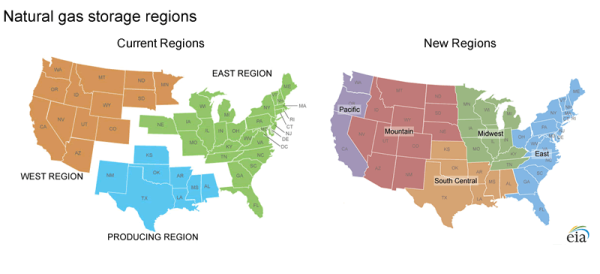

Last but not least, in an attempt to better reflect the physical market’s characteristics, last week the EIA began reporting storage in five regions, rather than three regions. The map of both the historical and new regions is shown below.

The East has been broken in two, Midwest (green) and East (blue). The West is now the Pacific (purple) and Mountain (red). The Producing region loses New Mexico to the Mountain region and has been renamed South Central (orange).