3 min read

Are SDRs Exposing the Details of Large Oil Hedging Transactions?

Based on our conversations with hundreds of commodity hedgers, its safe to say that many, if not most, participants in the energy commodity markets,...

3 min read

Mercatus Energy : Jan 27,2015

In recent weeks, there have been a lot of stories floating around about the "oil storage trade" but we've yet to see a good layman's explanation of how it actually works in practice. This is going to be the focus of today's post.

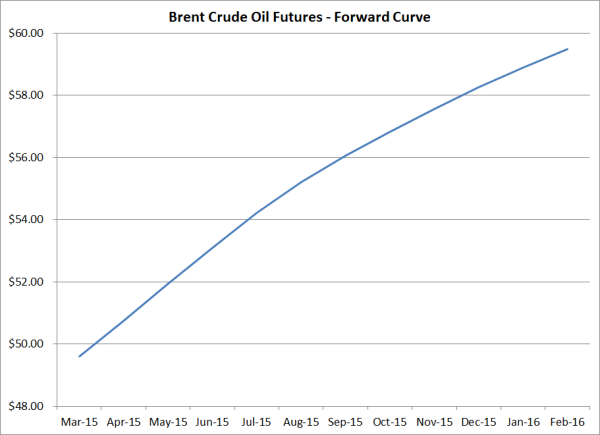

As the following chart indicates, the forward curve for crude oil is currently in what the trading world calls a contango. In essence, it means that the price for spot (or the nearby futures contract) crude oil is trading at a discount to crude oil to be delivered in future months. What causes a contango? The vast majority of time it is simply a situation where supply is greater than demand. So, to the question at hand, how do traders execute a trade(s) to take advantage of a contango? In short, they buy crude today (at the current spot price), put it in storage and sell it at a future date at the then higher price. However, as is often the case in the trading world, it's not quite so simple.

Let's assume that you buy physical Brent today for $50/BBL with intent of selling it in November at the current forward price (based on the December futures which expire on November 13, 2015) of $57.50/BBL. In order to lock in this profit, you need to sell an equivalent volume of ICE Brent crude oil futures or swaps at the current forward price of November futures which or $57.50/BBL. In addition, your storage cost (not just storage but also your cost of capital) between now and December needs to be $7.50/BBL or less.

So how do the mechanics of this trade actually work in the real world? First, you buy and take delivery of physical Brent today, at a cost of $50/BBL, and place it in storage. Next, you simultaneously sell the equivalent volume of ICE Brent crude oil futures. The combination of these two locks in your gross profit of $7.50/BBL. You then subtract your cost of storage, say $5/BBL, to get to your net profit, in this example $2.50/BBL.

What happens if crude oil prices increase or decrease significantly between now and December? Let's take a look at the former scenario first. Let's assume that when November '15 arrives that the then prompt ICE crude oil futures contract is trading at $75/BBL. For sake of simplicity, let's assume that you sell the crude you have been holding in storage for $75/BBL. On the physical trade, excluding your storage costs, you have a gain of $25/BBL. If we further assume that you buy back your futures for $75/BBL, you will have a loss on your futures hedge of $17.50/BBL. The combination of these two (the $25 gain on your physical storage position and the $17.50 loss on the futures hedge) leads us back to the original contango or carry of $7.50/BBL. In this scenario, as expected, your profit on the trade, again excluding storage costs, is $7.50/BBL. If your storage costs between the day you entered the trade and the day you exit the trade are less than $7.50/BBL, then you will have a profit of $7.50/BBL minus your storage costs. In the case of this example, if your storage costs are $5.00/BBL, your net profit of $2.50/BBL.

Let's now take a look at the latter scenario, an environment in which prices decline significantly between now and November. Let's assume that when November '15 arrives that the then prompt ICE crude oil futures contract is trading at $25/BBL. For sake of simplicity, let's assume that you sell the crude you have been holding in storage for $25/BBL. On the physical trade, excluding your storage costs, you have a loss of $25/BBL since you paid $50/BBL and are selling at $25/BBL. If we further assume that you buy back your futures for $25/BBL you will have a gain on your futures hedge of $32.50/BBL. The combination of these two (the $25 loss on the physical and the $32.50 gain on the futures) once again leads us back to the original contango or carry of $7.50/BBL. In this scenario, your profit on the trade, again excluding storage costs, is again $7.50/BBL. Again, if your storage costs between now and the time day than you initiate the trade and the day you exit the trade are less than $7.50/BBL then you will have a profit of $7.50/BBL less your storage costs.

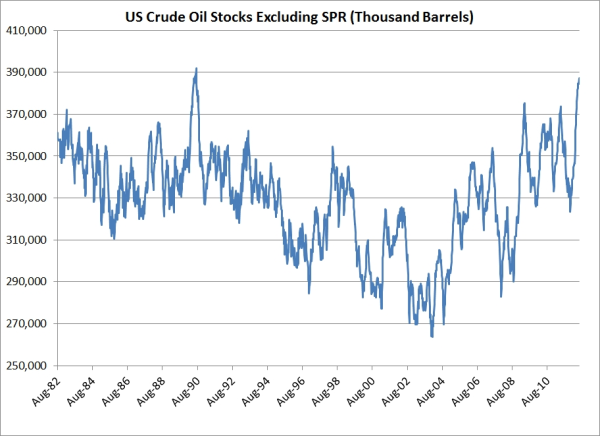

Among other things, it is the availability of this trade, also known as an arbitrage opportunity, that is leading crude oil inventories to increase as they have been in recent weeks and months. While many stories have been written about traders utilizing this strategy in Cushing and Singapore, it's a popular strategy anywhere with spare storage capacity, including VLCCs (very large crude carriers). According to several sources, there are approximately 40MM BBLs of "floating storage" accomidating the contango trade at the moment.3 min read

Based on our conversations with hundreds of commodity hedgers, its safe to say that many, if not most, participants in the energy commodity markets,...

2 min read

Heading into the weekend, it appears that Brent crude oil may settle the day at below $90/BBL for the first time since December of 2010, while WTI...

2 min read

This post is the second in a series on crude oil options. This first post in the series can be found via the following link: A Beginner's Guide to...