Will Consumers Make The Same Hedging Mistakes as Many Producers?

I spent the holidays on the road between Houston and Nebraska visiting family. The trip took me though some rural communities where it is common to find local farmers, truckers, etc. sitting around the table at a truck stop or diner discussing the important topics of the day. As you might imagine, fuel prices are among those topics.

I had a chance encounter with one of these groups in Sabetha, Kansas. A group of local businessmen were discussing expected prices for diesel fuel. In fact, they had been advised to buy their diesel for the coming year because, “crude oil will be at $90/BBL by February.” They went on to ask me my opinion on prices and if I agreed that crude oil prices could reach $90 by February. As those who read this blog regularly may guess, I don't consider price forecasts to be of significant value when it comes to hedging commodity prices. Here is a summary of what told them instead:

Don’t waste time focusing on fuel price forecasts

With 20/20 hindsight we can confidently say, those oil and gas producers who refused to hedge because they expected oil and gas prices to remain relatively high or even increase missed an opportunity. Many may find themselves seriously constrained as a result. For reasons I will never understand, many market participants want to focus on price forecasts and only hedge when forecasted price are less attractive than the price they want or need in order to meet or exceed their business goals. No one can consistently oil and gas forecast prices with a significant amount of accuracy. This is especially true when a major shift occurs, like the one we’ve seen over the last few months.

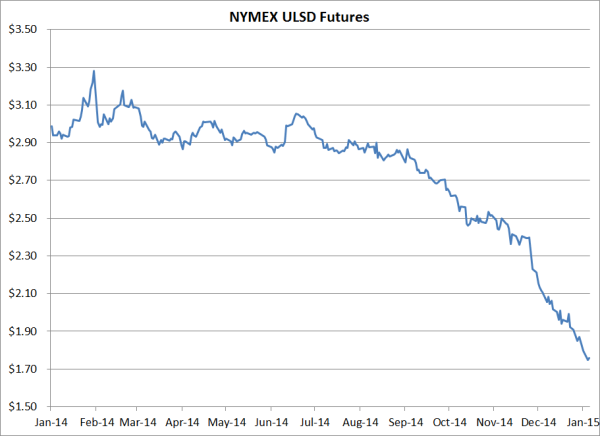

For consumers, current forward prices likely present an opportunity to hedge commodity price exposure at a price drastically lower than the budgeted price. So does it matter if an analyst hiding behind a collection of computer monitors, but with no experience running your company, thinks prices might decline by another 10%? More importantly, how much will it cost you if the analyst is wrong and prices rise 10% or more?

I don’t doubt that oil prices will rebound significantly by February, but I wouldn’t advise you to bet your company on my opinion. Instead of asking about price expectations, or wasting time trying to forecast prices, let’s discuss how you can minimize your exposure to volatile prices. There are ways to limit exposure AND participate should prices fall, topics we've covered times before. For example, in a post titled Opportunistic Diesel Fuel Hedging Strategies as Oil Markets Collapse, we explained how diesel fuel consumers can hedge with a strategy known as a call option spread.

Hedging doesn’t have to be all or nothing

My new friends in Sabetha asked if they should lock in the price of their expected diesel fuel consumption. As is commonly the case, never did they ask how they might determine if some volume less than 100% would be a smart hedging strategy. Far too few would be hedgers consider the potential benefit of gradually hedging their exposure, a process some refer to as “legging in” and similar to dollar cost averaging. We spend a good portion of our time working with clients to devise strategies that includes analysis and guidelines for determining what percentage of your exposure you might hedge at a given time or price. There is nothing that requires anyone to hedge 100% of their exposure all at once.

Consider the motivation and bias of your market information

I can’t stress this point enough. Consider from whom you are receiving advice to hedge or trade your commodity price exposure. What do they stand to gain from your trade?

If you are a large consumer of diesel fuel in Sabetha and your broker is advising you to commit to buy the entire volume today, which happens to be toward the end of the month during the last month of the year, might he have a special interest in getting that sale closed before the end of the year?

The same goes for advice you may get from bankers, futures brokers, derivative marketers, traders, etc.. They may have a hot trade idea or a cheaper way for you to hedge, but before you execute a trade, you need to determine their motivation. Many energy consumers and producers often regret accepting the hot trade idea or cheap hedging strategy when they later learn the "hedge" required that they accept a significant amount of risk, risk which often far exceeds their actual tolerance for risk. For example, we recently received an inquiry regarding a strategy they called an “extended collar.” This isn't a common term or strategy utilized in the energy markets, but it isn’t uncommon for people to assign creative names to such strategies as doing so often creates an easier sale for the broker, marketer or trader.

A basic consumer collar is constructed by selling a put option to finance a portion of the purchase of a call option. To “extend” this collar, and lower the premium, this company's bank persuaded them to sell a second put option on a contract month that was one month further in to the future than the original collar. This allowed the company to lower the strike price on the puts they were selling to the bank. It might sound good until you consider that company is now incurring losses which are twice, or nearly twice, as large as they would be incurring if they had simply hedged with the basic collar strategy. Not to mention, the significantly larger volumes neither matched the company's fuel consumption nor qualified as a “hedge”.

Conclusion

Commodity prices have fallen drastically since last summer. This presents a good opportunity for the consumers among our readers. It is important to analyze this opportunity objectively and to understand what it means for your unique circumstances. With that information, you can better understand how best to hedge in the current price environment.

A complete fuel procurement and hedging program will consider these questions regularly. Regularly reviewing these questions allows you to capture opportunities when the market presents them. More importantly, it reduces the pain when the market doesn’t behave as you expect, which happens more often than most care to realize.

As you begin the new year, contact us and utilize our experience and expertise to help you address your hedging challenges. We know hedging energy commodity prices can be a daunting task but it's our core business and we look forward to helping you navigate what can often appear to be a complex, black hole.

If any of the guys I met in Sabetha happen to reading this post, give me a call, I’d love to continue our discussion.