2 min read

An Introduction to US Gulf Coast Crude Oil Hedging

As the Gulf Coast continues to becoming an ever more active crude oil trading hub, the interest in hedging Gulf Coast crude oil is increasing as...

2 min read

Mercatus Energy : Dec 20,2014

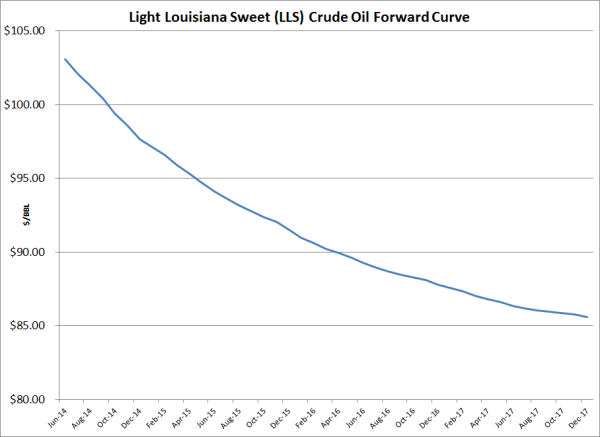

On Friday we updated a previous post which explored oil and gas producer hedging with a strategy known as a three-way collar. As we noted in the updated post, many producers are currently experiencing significant oil hedging losses as a result of hedging with three-way collars as said collars include the sale of put options, many of which are currently in-the-money. While it’s not possible to eliminate these losses, there are strategies which can be utilized to ensure that the losses do not increase should prices continue to decline.

As we noted in the previous post, a producer who has hedged with a three-way collar involving the sale of a $100/BBL call option, the purchase of an $85/BBL put option and the sale of a second put option at $75/BBL is currently experiencing hedging losses due to the sale of the $75/BBL put option. Producers who need to ensure that they are not exposed to any further losses, if prices continue to decline, should consider modifying their existing positions by purchasing an additional put option, selling a swap or buying back the $75/BBL put option.

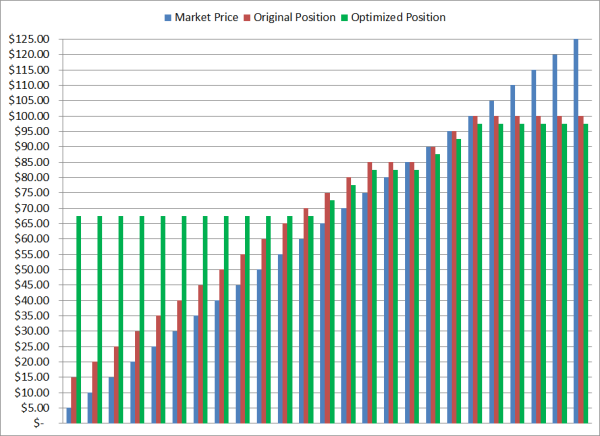

First let’s explore the scenario of purchasing of an additional put option. In the example above, the producer is currently incurring losses due to the sale of the $75/BBL put option. To mitigate any further losses one strategy the producer could execute is the purchase of an additional put option, for example a $60/BBL put option. For the sake of this example, let’s assume that the premium of the $60/BBL put option is $2.50/BBL. In this scenario, the producer’s losses, should prices remain below $60/BBL, would be capped at $15/BBL as purchase of the $60/BBL put option would produce gains which would offset any additional losses associated with the sale of the $75/BBL put option. The following chart shows the before and after profile of the original and modified positions, including the $2.50/BBL premium.

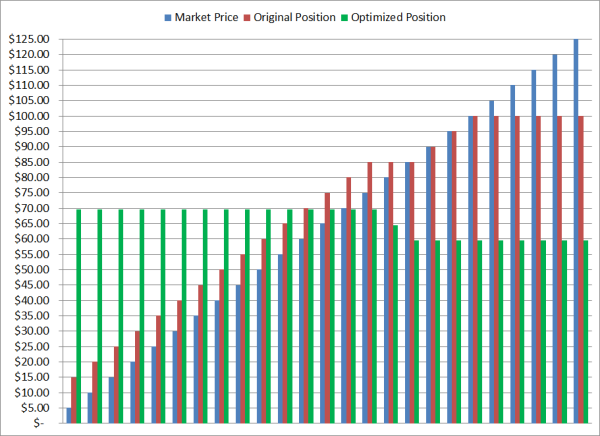

Next, let’s consider the sale of a swap, for example a $60/BBL swap. The sale of a $60/BBL swap would also eliminate any future losses associated with the sale of the $75/BBL put option as the $60/BBL swap would produce gains, should prices settle below $60/BBL, which would offset any additional losses associated with the sale of the $75/BBL put option. However, the sale of the swap isn’t as advantageous as purchasing an additional put option, as explained above, as the swap is subject to losses if prices settle above $60/BBL. That being said, if the producer chooses to mitigate their exposure by selling a $60/BBL swap they will also want to buy back the $100 call option as not doing so would result in being short at both $60 and $100. For sake of this example, let’s assume that the $100 call option can be bought back for $0.50/BBL. You can see the before and after profiles of this scenario in the following chart.

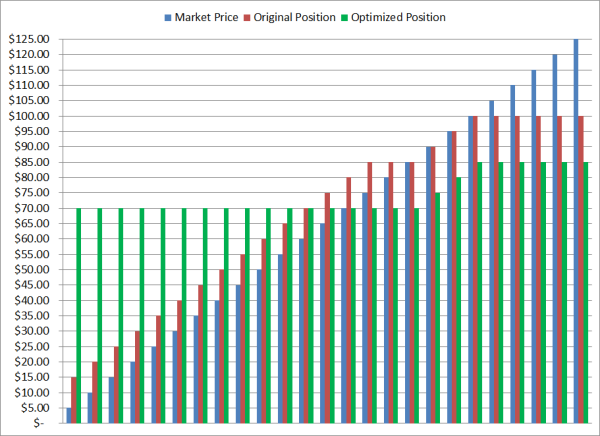

Now let’s explore the scenario which involves buying back the $75/BBL put option. This scenario is certainly the most expensive in terms of out-of-pocket costs but it does completely eliminate additional losses while also provide upside participation, unlike the $60 swap. Let’s assume that based on current market prices the current price of a $75/BBL put option is $15/BBL. Clearly paying $15/BBL isn’t feasible for most producers but, given that this strategy completely eliminates further losses associated with the $75/BBL put option while also retaining the ability to benefit from higher prices, we felt obliged to include this scenario as well. The before and after profiles of this strategy is shown in the following chart, including the $15/BBL premium.

While it’s safe to say that most producers won’t consider any of these three strategies to be ideal, all of these strategies provide producers with a way to mitigate the losses which are currently being experiencied as a result of hedging with three-way collars. If you would like to explore alternative ways to mitigate your crude oil hedging losses don't hesitate to contact us.

2 min read

As the Gulf Coast continues to becoming an ever more active crude oil trading hub, the interest in hedging Gulf Coast crude oil is increasing as...

3 min read

In a recent Bloomberg article, “In a Risky World, Oil Traders Bet on $100 a Barrel” the author explored how, “Some oil traders have started to gear...

3 min read

In recent weeks, there have been a lot of stories floating around about the "oil storage trade" but we've yet to see a good layman's explanation of...