How Will Global Oil Markets React to Tomorrow's OPEC Meeting?

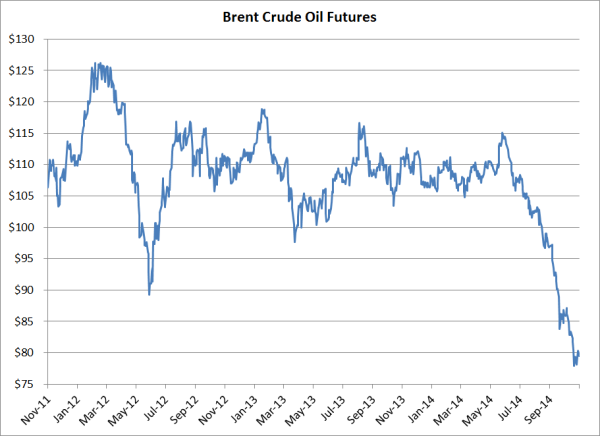

While the US energy markets will be closed for the Thanksgiving holiday tomorrow, nearly everyone who has any interest in the global oil and gas markets will be watching the headlines for any meaningful news to come out of the OPEC meeting in Vienna. As of last night, our best sources indicate that the cartel has so far been unable to reach a pre-meeting agreement. In addition, several, very interested, non-OPEC parties (i.e. Mexico, Russia) are also in Vienna trying to make their respective cases to reduce supply or not. We've also heard, but can't confirm, that IPAA (Independent Petroleum Association of America) has sent a respresentative(s) to Vienna to voice their opinion on the matter.

What are OPEC's potential decisions and how will the oil markets react to their decision? First, it's important to note that OPEC's current quota is 30MM BPD, although it can certainly be debated as to whether or not the cartel is actually supplying 30MM BPD, more or less. In addition, over the past couple day a couple sources are suggesting that if OPEC does indeed decide to decrease production, several members (e.g. Iraq, Iran and Syria) will not be "required" to comply. Such exclusions clearly create challenges of their own. Futhermore, many analysts are forecasting US shale production to increase 1MM BPD and non-OPEC, non-US production to increase by 500K-750K BPD in the new year. Clearly these forecasts may be too optimistic if prices remain near current levels.

Back to OPEC's potential decisions and how the market will react, here are a few scenarios to consider:

Scenario I: Reduce supply by 1MM BPD or more. This scenario could also include additional reduction commitments from individual members i.e. Saudi Arabia. In this scenario, most would conclude that the cartel is telling the market that they need/want higher prices and they are committed to making it happen. How will the market potentially react in this scenario? Prices increase slightly in the short term and higher in the medium term, if and when the market sees evidence of OPEC actually reducing supply.

Scenario II: Reduce supply by 500K BPD. In this scenario, most would conclude that the cartel is telling the market that they would prefer higher prices but they aren't fully committed. How will the market potentially react in this scenario? Prices decline by $5-$12 in the short term and slowly rise, if and when the market sees evidence of OPEC reducing supply.

Scenario III: Maintain current quota of 30MM BPD. In this scenario, most would conclude that the cartel couldn't come to an agreement. As such, this would likely create a scenario where members are in their own self-interest. In practice, this would likely mean that most members will maintain current production levels as most members require prices which are significantly higher than current market prices. To clarify, when we say scenario we aren't referring the break even production price but the fiscal breakeven price. Fiscal Breakeven can be defined as the price at which a country’s fiscal balance is zero. Fiscal Balance can be defined as the balance of a government's tax revenues, plus any proceeds from asset sales, minus government spending. If the balance is positive, the government has a fiscal surplus, if negative a fiscal deficit. For more on this see Sovereign Oil & Gas Hedging - A Different Perspective.

Scenario IV: Increase supply by any amount. While it's incredibly unlikely that the cartel would come to this conclusion as official decision, should oil prices continue to decline in the short run, it is certainly possible that we could see some members, particularly those who are facing significant economic challenges, increase the volumes that they are supplying to the market. Why? Simple mathematics. At a lower price level, one must sell additional barrels to maintain revenue at existing levels. The problem with this scenario is that it will continue to drive prices lower. That being said, it could be argued that such a scenario isn't completely out of the question as it is the scenario which would lead to lower growth in US shale production, an ideal outcome for OPEC members, although the interim economic pain of such a scenario would certainly create additional challenges most, if not all, OPEC members.

Are there other potential outcomes and scenarios? Most certainly but given that OPEC as an organization and the individual member countries have both been rather quiet and opaque heading into the meeting, it's difficult to say what the alternative outcomes and scenarios might be, although a surprise of some sort is certainly a possibility.

How can one mitigate their oil price exposure ahead of the meeting? We would suggest staying on the sidelines of the oil market and going long turkey and dressing. If that's not an option, see Hedging Against A Potential Oil Price Spike which addresses a variety of different hedging strategies.