Sovereign Oil & Gas Hedging - A Different Perspective

How Do Sovereign Energy Companies Influence Commodity Markets and Expectations?

Petróleos Mexicanos (Pemex) makes headlines about once per year with its hedging program (see Mexico Said to Begin 2015 Oil Hedge as an example). It is an important event on many levels. In the near term, the sheer size of Mexico’s national oil company’s (NOC) hedging program can temporarily move markets. In the long term, hedging programs likes Pemex’s can offer insight in to long-term energy price fundamentals. In this post we will revisit some of the similarities and differences between sovereign hedging and corporate hedging, review Pemex’s hedging program’s observed effects on near term markets, and discuss how NOC target prices can contribute to long term fundamental analysis.

Sovereign Hedging

Before we get in to any specifics about Pemex or discuss sovereign hedging as an analytical input, let us quickly review sovereign hedging vs. private entity hedging.

The practice of hedging is largely similar for sovereign entities and private companies. In short, both will consider internal objectives, risk tolerance, financial commitments, physical operations, credit, and market conditions in their efforts to devise a risk management program that balances benefits and costs in a portfolio that mitigates price risk. Both types of entity have access to the same tools of risk mitigation – contractual structures, derivative instruments, vertical integration, structured products, etc. From this perspective, it is difficult to demonstrate a substantial difference between the two types of entities and their risk management programs. Only when it comes to size do sovereign entities begin to stand out in the practical sense.

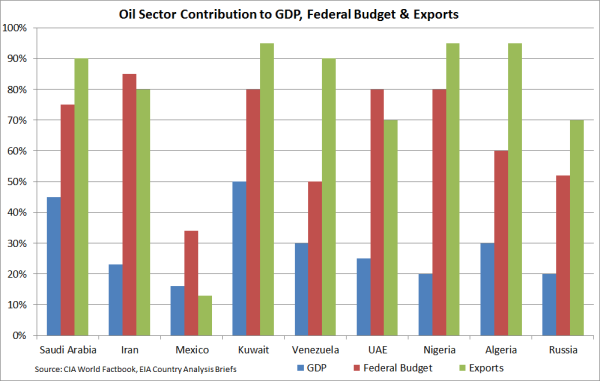

It is in their ultimate stakeholders and resulting decision-making processes that sovereign entities really differ. Private companies can typically define stakeholders in a broad sense. For example, public companies have shareholders, partnerships and independently owned firms have legal owners, and companies with debt have obligations to creditors. Most sovereign entities, on the other hand, have one true stakeholder – their government. It is estimated that Pemex revenue, for example, funds about one third of Mexico’s federal budget. As you can imagine, this characterizes the risk of downward crashing prices a bit differently. The same is true for most, if not all, sovereign entities. Be it an oil-producing NOC or a refined product marketer, these entities typically operate under some condition or limitation created by government policy. Subsidies, government employment, welfare programs, etc. are largely dependent on the revenue generated by the NOC. The following chart ranks some of the largest NOCs’ contributions to their home countries’ federal budgets.

As the chart indicates, NOCs contribute disproportionately to their home countries and governments. As a result, the risk associated with oil and gas production is an important consideration for both NOC leadership and politicians charged with oversight.

Market Impacts - In the Short Run

Considering the importance of NOC revenues to their home countries, it is not surprising to see a company like Pemex pursuing conservative hedging strategies. Pemex has historically hedged using primarily long options strategies, buying puts as a form of insurance against downward price shifts that may prove catastrophic. Even when Pemex has diverted from this strategy, it has remained conservative, using combinations such as put spreads to limit the effects of downside price movements and reduce costs. We previously commented on Pemex’s use of put spreads in the article titled New Look at Sovereign Oil Hedging Strategies. How can such conservative strategies affect markets?

In the short term, especially if Pemex moves to hedge a large majority of its volume in a relatively short span, a hedge program of this size can do a couple of things to affect the market:

- Large volume of option buying puts upward pressure on option premium;

- Coinciding requirement for the counterparty selling the put to hedge its new exposure will have a tendency to put downward pressure on the price of the underlying commodity swap.

Markets tend to return to normal over time, but you can see how one large company’s decision can influence things for a short time. The same would be true if any company executed a hedge program all at once, it does not matter that Pemex is an NOC.

Market Impacts - In the Long Run

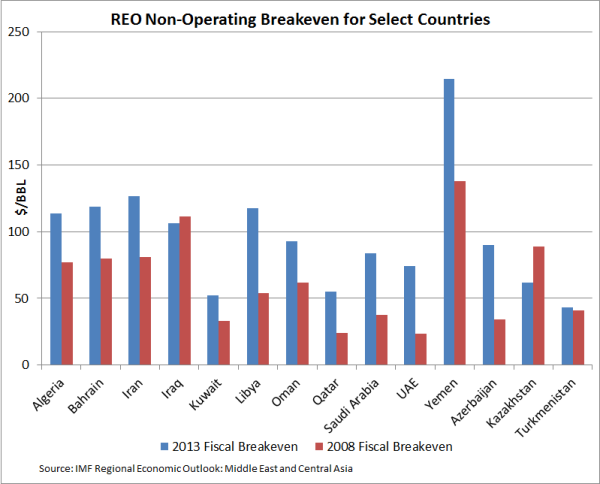

Sovereign oil company market influences are not limited to the near term. Many of the countries hold enormous amounts of hydrocarbon reserves. Consequently, their upstream activity can influence prices. One must account for this activity in long-term analysis. Fundamental analysts use this information to gauge long-term trends or put rough bounds around prices. In doing so, analysts use more than the basic operational finances of the asset for making forecasts. For example, the International Monetary Fund publishes an annual report on “fiscal breakeven” for major oil exporting nations in various regions. The following chart is from the most recent of these reports, the November 2013 Regional Economic Outlook: Middle East and Central Asia.

Chart Notes: Fiscal Breakeven (IMF): The price at which a country’s fiscal balance is zero. Fiscal Balance: The balance of a government's tax revenues, plus any proceeds from asset sales, minus government spending. If the balance is positive, the government has a fiscal surplus, if negative a fiscal deficit.

Analysts use information like that contained in the WEO report and Figure 2 to gauge activity of major oil producing states, and ultimately create forecasts for prices and production. Regardless of what you think of long-term oil price, this sort of input can be quite useful. It does not take much imagination to think of instances when policy makers or fundamental analysts might use such information:

- Policy makers in the US might consider the information when debating the merits of lifting crude oil export bans from the US. One could model scenarios of US crude oil exports that drive international prices downward toward, possibly below, fiscal breakevens as a means of investigating political ramifications in counties dependent on revenues from oil exports.

- Fundamental analysts may use the information to create long-term oil production scenarios, using price influences to model the behavior of major oil producing states or estimate the affect supply swings may have on prices or producer behavior.

- Fundamental analysts might attempt to forecast prices based on “swing producer” activity under certain scenarios to estimate long-term floor prices for oil indices. The behavior of Saudi Aramco is maybe the most commonly referenced and discussed example of this analysis. Here is a recent example from Reuters – Delegates: OPEC Unruffled by Oil Price Slide, Sees Market Rebound.

This type of analysis has a home in a complete risk management program, as well. Risk management is about more than just trade strategy and derivative valuation. A complete program includes risk analysis, which can extend to scenario analysis, specifically stress testing. Stress tests assess a portfolio’s reaction to a series of events or estimate how changes in certain independent variables will affect a portfolio. Just as the political and fundamental analysts in the examples above use NOC activity and financial estimates in their modeling and forecasting, a risk manager can use this information to create realistic (even if extreme) scenarios that help assess risk in his portfolio of assets or hedges.

Conclusion

NOCs own or manage a large portion of the world’s energy assets. As such, they have influence over markets, intentional and unintentional. A good risk manager will consider whether the activities of NOCs have a material effect on his portfolio and use the information provided by NOCs and the analysts that study NOCs to optimize his risk management program. Contact us if you would like to review your portfolio for potential exposure to NOCs or to learn how to incorporate this type of information into your proprietary market analysis.