Bunker Fuel Price Risk Management - Crude Oil Options & Crack Spread Swaps

As many participants in the bunker fuel market are constantly seeking better strategies to hedge their exposure to fuel price risk, we wanted to explore a hedging strategy which we don't see utilized regularly but could be a great strategy for many companies. While this strategy may seem complex, it's really quite simple if you break it down into two separate components, an option on WTI or Brent crude oil and a USGC fuel oil crack spread.

As an example, let's consider the case of a ship owner who is looking to hedge their anticpated May Gulf Coast bunker fuel consumption. Let's assume that the company would prefer to hedge with call options as they need to be protected against rising Gulf Coast bunker fuel prices but they also want to be able to benefit should Gulf Coast bunker fuel prices decline. While there is a market for Gulf Coast bunker fuel options, it's not very liquid market, as evidenced by the lack of open interest in the Gulf Coast No. 6 Fuel Oil 3.0% Average Price Options. This being the case, the company can construct a hybrid hedge by purchasing an average-price call option (also known as an APO or Asian option) on WTI crude oil and a calendar swap on the USGC fuel oil crack spread.

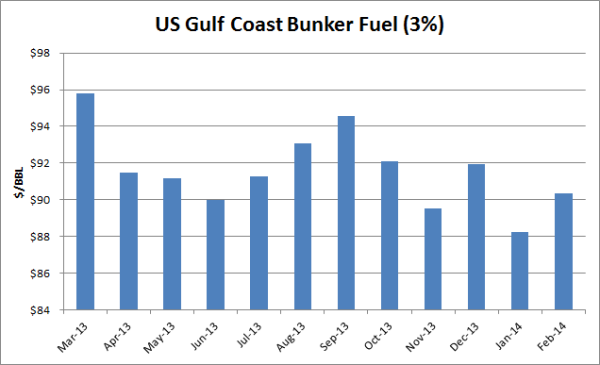

The price of the calendar swap on the USGC fuel oil crack spread is determined by the average of the mid-point between the high and low prices for Platts' Gulf Coast fuel oil (No. 6 3.0% sulfur - Waterborne) minus the average settlement price for the prompt NYMEX WTI crude oil futures contract for each business day during the month. As an example, in February, the average of the mid-point between the high and low prices for Gulf Coast fuel oil for each business day in the month was $90.37/BBL while the average settlement price for the prompt NYMEX WTI crude oil futures contract for each business day during the month was $100.68/BBL. As a result, the USGC fuel oil crack spread settled at -$10.31 (note that the settlement was negative as fuel oil was/is trading at a discount to crude oil).

Back to the ship owner looking to hedge their May bunker fuel consumption, let's further assume that the company wants to hedge at as close to the current forward market prices as possible. As such, based on current market prices, the company could purchase a May $99.00 WTI APO call option for $2.25/BBL. In addition, based on current market prices, the company could purchase a May USGC fuel oil crack spread calendar swap for -$9.43/BBL, which is based on a May Gulf Coast fuel oil calendar swap at $89.10/BBL and a May WTI crude oil calendar swap at $98.53/BBL. Again, note that the fuel oil crack spread swap is negative.

So, how does this strategy perform if crude oil and bunker fuel prices are both higher and lower in May? First let's consider the case if the prompt month WTI crude oil futures average $110/BBL and Gulf Coast bunker oil averages $100.57/BBL. In this case, the company will have a hedging gain on the WTI call option of $11/BBL ($110-$99=$11) but neither a gain or loss on the fuel oil crack spread swap as it settled at the same price the company paid for the swap, -$9.43/BBL ($100.57-$110=-$9.43).

Next let's consider the outcome if the prompt month WTI crude oil futures average $90.00/BBL and Gulf Coast fuel oil prices average $85.00/BBL. In this case, the company will not have a hedging gain or loss on the WTI call option as the option is out-of-the-money (the settlement price of $100/BBL is less than the strike price of $110/BBL). However, they will have a gain of $4.43/BBL on the fuel oil crack spread swap as the swap settled at -$.5.00/BBL ($85.00-$90.00=-$5.00). That being said, if the fuel oil crack spread settled at -$9.43/BBL or less, the company would have realized a loss equal to the difference between the settlement price of the fuel oil crack and -$9.43/BBL.

In summary, given that the market for Gulf Coast bunker fuel options is rather illiquid, participants in the bunker fuel market who desire to hedge with options can do so via a hybrid hedge through a combination of crude oil options and fuel oil crack spread swaps. While this example is based on the perspective of a bunker fuel consumer looking to hedge against potentially higher prices, if a company needed to hedged against potentially lower prices, they could employ a similar strategy whereby they would purchase a put option, rather than a call option, on crude oil and combining it with a fuel oil crack spread swap.