Electricity Marketer Goes Belly Up Due to Hedging Problems

What happens when an electricity marketer sells their customers fixed price power but doesn't properly hedge their exposure and prices increase significantly? More often than not, the marketer blows up and is forced to turn off the lights indefinitely. This appears to be what recently occurred in the case of, Clean Currents, a Maryland based power marketing company.

According to a message posted on their website, the company's explanation is the following: "We are writing to inform you, with deep regret, that the recent extreme weather, which sent the wholesale electricity market into unchartered territories, has fatally compromised our ability to continue to serve customers."

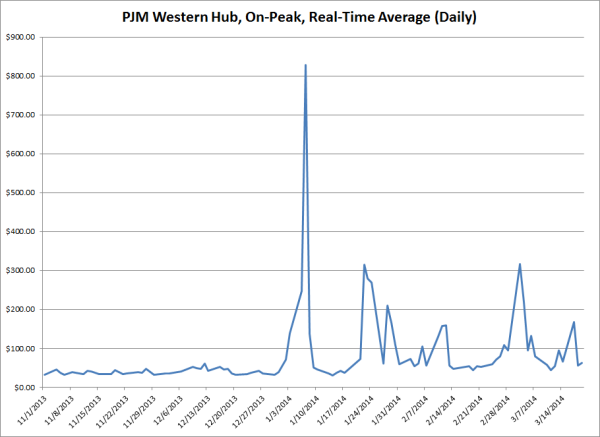

So, what's the real story? Without firsthand knowledge of their exact situation it's difficult to say precisely but, if we use January PJM Western Hub prices as a proxy, the real story is probably pretty simple. After averaging $41.93/MW from Nov. 1 - Dec. 31, PJM Western Hub, day-ahead, on-peak prices spiked, ending January at an average of $164.76/MW. Similarly, real-time, on-peak prices averaged $39.51/MW from Nov. 1 - Dec. 31 but averaged $154.45/MW in January and as high as $828.37/MW on Jan 7, a day which included prices reaching nearly $2,000/MW in some zones.

If we further assume that the power marketer sold their customers fixed price power at say, $100/MW, quite rich based on historical prices, and they did not execute a "back-to-back" hedge to mitigate their exposure to said sales, they likely faced losses of at least $64.76/MW on at least a portion of their sales. In addition, if their supply/demand forecasts weren't very accurate, which is essentially a certainty given impact of the Polar Vortex, they most likely found themselves in a position where, at least for a few hours, they were paying well above $1,000/MW. Regardless of how you calculate the losses, their lack of a sound hedging program forced the company to close their doors and exposed their customers, who thought they were well hedged, to unprecedented spot prices.

For those of you who aren't very familiar with power markets, perhaps the following analogy will be helpful. Assume that a crude oil marketer had sold WTI crude oil to most of their customers at a fixed price of $100/BBL, for January delivery, and that the marketer didn't hedge some percentage of said sales. Further assume that in January the price of WTI averages $225/BBL. How many marketers could easily survive a $125/BBL loss on every unhedged barrel?

In summary, if you market energy commodities (crude oil, electricity, diesel fuel, etc.) and sell your customers embedded derivatives (fixed price, capped price, collars, etc.), it is imperative that you properly hedge your exposure to said embedded derivatives. That being said, many companies will continue to ignore this advice, as many others have done in the past (e.g. Texas Commercial Energy), virtually guaranteeing that we will continue to witness failures of this nature for many years to come.