Natural Gas Trading at Premium to Crude Oil?

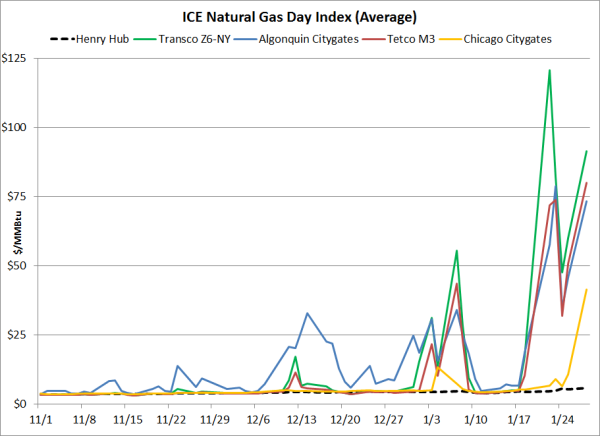

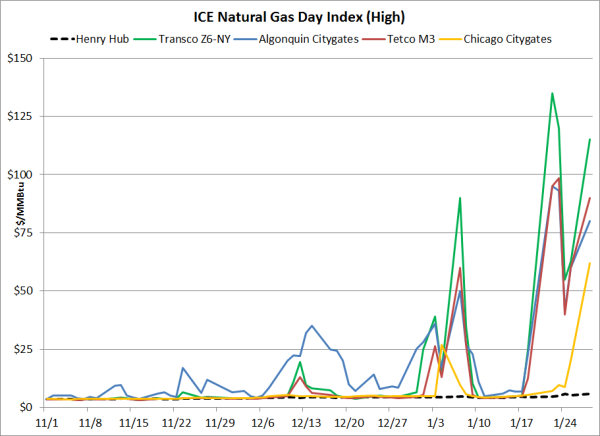

If you don't follow the US physical natural gas markets, you would probably be surprised to hear that spot prices in several regions are currently trading at price levels which could very easily be mistaken for crude oil. As a case in point, yesterday Transco Z6-NY (New York City) natural gas traded as high as $115/MMBtu, ending the day at an average of $91.264. As a comparison, prompt month NYMEX WTI and ICE Brent crude oil futures settled yesterday at $95.72 and $106.69, respectively.

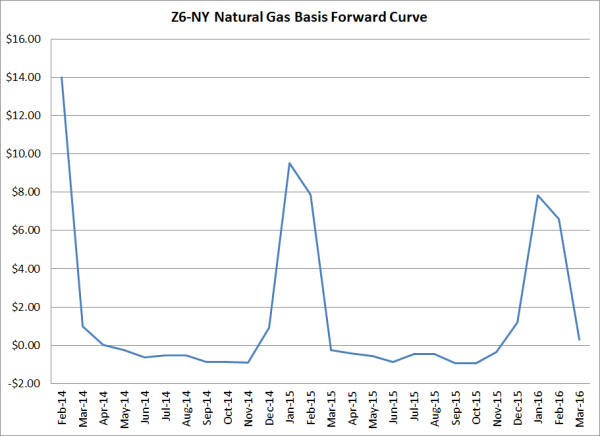

While it's safe to say that many natural gas traders and analysts were expecting Northeast prices to be strong this month given that the Z6-NY month ahead index gas January averaged $9.189, very few were expecting prices to trade as high as they have in recent days and weeks. As an example, as recent as July 23, January Z6-NY basis swaps were trading as low as $1.234 over January NYMEX natural gas futures (at which time January NYMEX was trading at $4.065), which means that on July 23, one could have locked in January Z6-NY natural gas at $5.299, nearly $110/MMBtu less than the current spot price.

While not quite as extreme, as you can see on the following chart, Algonquin Citygates (Boston), TETCO M3 (Mid-Atlantic) and to a lesser exent, Chicago Citygates spot prices are trading at/have recently traded at all-time, or near all-time, highs as well. Yesterday, Algonquin, M3 and Chicago averaged $73.296, $79.846 and $41.308, respectively. As was the case with Z6-NY, all of these markets offered significantly lower forward prices in the summer as well.

So why are basis prices "blowing out" in these markets? In short, because there simply isn't enough pipeline capacity into these regions to meet peak demand. While there are many different ways to explain this perhaps the easiest way is as follows: the cost of firm ("guaranteed") capacity (pipeline transportation) from Henry Hub to Z6-NY is about $1.00/DT. In layman's terms, this means that if you own firm capacity from Henry Hub to Z6-NY, your landed cost for Z6-NY natural gas today would be approximately $6.689 as Henry Hub averaged $5.689 yesterday.

So how long will basis prices in these regions remain at such elevated levels? As can be seen on the following chart, as of today the market is indicating that basis prices are likely to retreat back to "normal" levels in March. How can we say this with any sort of confidence? As of the close of business yesterday, February Z6-NY basis swaps settled at $14.000 while March Z6-NY basis swaps settled at $0.980. That being said, the market is clearly expecting Northeast basis to remain dear in the coming winters as January '15 and '16 Z6-NY basis swaps settled yesterday at $9.515 and $7.848, respectively.

While an in-depth explanation regarding managing/mitigating natural gas basis risk is beyond the scope of this post, the following posts address various aspects of basis risk and basis hedging.

An Overview of Energy Basis, Basis Risk and Basis Hedging

Energy Hedging - Back to the Basics Part IV - Basis Swaps

Revisiting Energy Basis Risk & The Impact on Airline Fuel Hedging

Basis Risk Leads to Unexpected Fuel Hedging Results